B Corp global investment firm Arowana launches impact-driven venture studio Vivarium

Arowana, the leading B Corporation-accredited global investment firm, today announced the launch of its impact-focussed venture studio, Vivarium, as it expands its mission to grow companies that address some of the world’s most pressing challenges, as articulated by the UN Sustainable Development Goals (SDG).

Vivarium partners with talented and resilient founders at an early stage who are ready to scale up solutions that advance societal and environmental welfare globally but require further strategic and operational support.

Led by a team of experienced venture builders, Vivarium focusses on building solutions to global challenges – from bridging the digital divide with universal access to technology and the internet; to addressing environmental crises such as plastic pollution with a waste-to-X approach; to building a more socially inclusive world with better opportunities in education and employment.

Vivarium looks to work alongside entrepreneurs in building ventures that tackle the UN SDGs where technology and innovation can make lasting changes for humanity. Initial SDGs highlighted as focus areas include SDG 9 (Industries, innovation, and infrastructure), SDG 10 (Reduced inequalities), SDG 11 (Sustainable cities and communities), and SDG 13 (Climate action).

At the beginning of the programme and throughout the early stages of venture development, Vivarium also provides seed funding and assists in securing investment from value-add co-investors in follow-on rounds.

Vivarium also offers resources and structured support by bringing together a talented and curious group of individuals with various specialisations, including operations, design, engineering, marketing & brand strategy, law, finance, and enterprise sales. These experts function as extensions of the founding team, providing expertise to navigate the growth journey of scaling global businesses. Teams will also have access to Arowana’s world-class advisory board and experienced team of entrepreneurs who have started, scaled, bought, fixed, operated, and exited businesses or gone public with an IPO, as well as access to a global network of potential customers, partners, and talent.

Santiago Tenorio, Executive Director, Vivarium, said: “We are thrilled to launch Vivarium, our impact-focussed venture-building platform. With an unparalleled pool of talent and an increased focus on sustainability, the potential for impact-driven ventures is greater than ever before. We believe this convergence of talent and focus creates the perfect environment for building innovative global businesses that tackle some of the world’s most pressing challenges. Our platform is dedicated to nurturing and empowering these ventures, helping them to scale their impact and build a better future for all. We are excited to work with entrepreneurs who share our vision and are ready to make a positive difference in the world.”

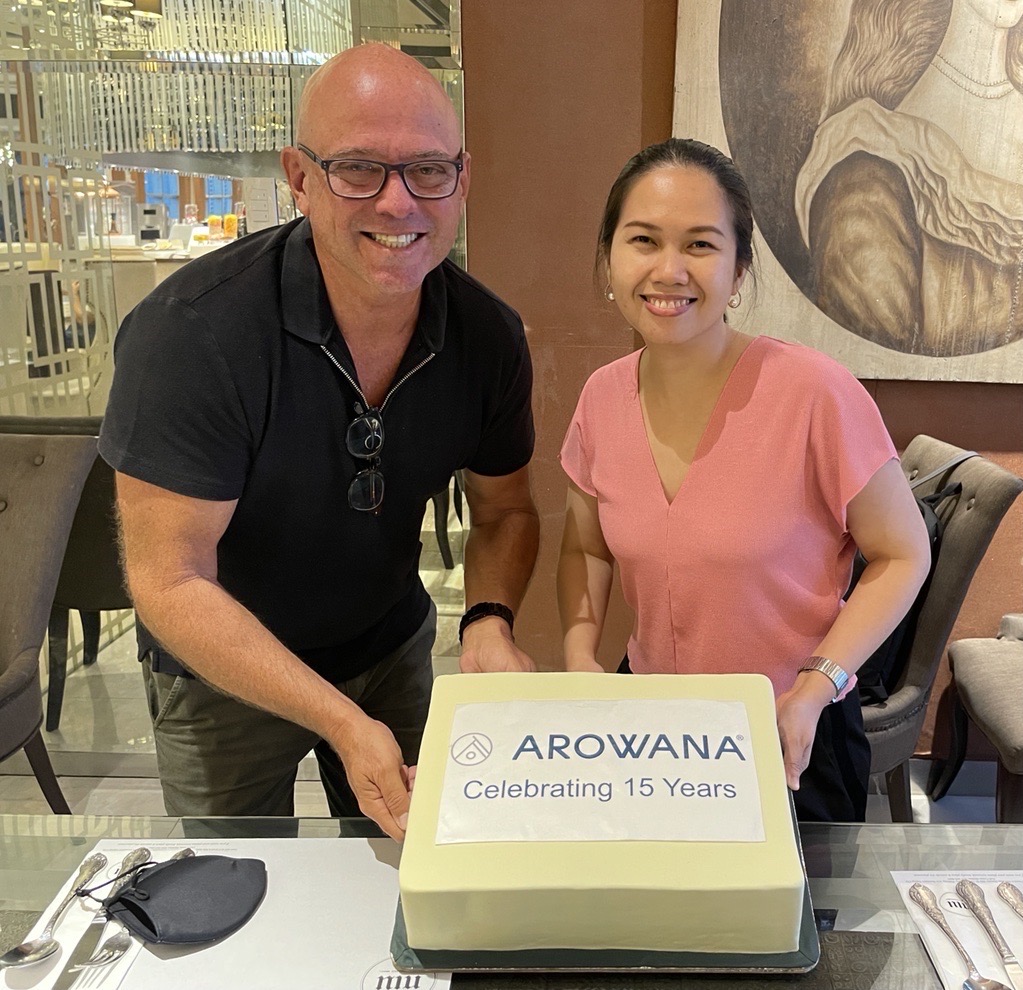

Kevin Chin, CEO and Founder, Arowana, said: “Vivarium is on a mission to help start-up founders turn their impact-focussed ventures into successful global companies. These founders are driving change in the world, and we are delighted to work closely with them on their journey. We are here to provide the resources, support, and experience needed to overcome the inevitable challenges of scaling up successfully and delivering on their mission of creating lasting impact. This aligns with Arowana’s core purpose of growing people, companies, and value.”

The launch of Vivarium follows the announcement today of the spin-off of Arowana’s growth-stage venture capital secondaries unit, Alicorn Venture Partners, where Arowana will maintain an economic interest going forward. This affords Arowana, through Vivarium, the opportunity to focus on impact-focussed primary investment opportunities that align with its B Corp triple bottom-line mantra of People, Planet, and Profit.

About Arowana

Arowana is a leading B Corp-certified global investment firm with several operating companies and investments in electric vehicles, renewable energy, vocational and professional education, technology and software, venture capital, and impact asset management. Arowana’s purpose is to grow people, companies, and value.

About Vivarium

Backed by Arowana, Vivarium is a venture studio and holding company established to solve the most fundamental problems that affect our society and our planet. We partner at an early stage with start-up founders who are mission-aligned to build scalable businesses that not only disrupt industries and are profitable, but also create meaningful impact in the world.