Interest rates in Australia are now lower than they were in the aftermath of the Global Financial Crisis (GFC). Why did the RBA cut interest rates in quick succession over the last two months?

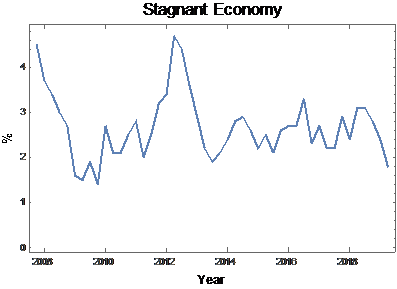

While the embers of growth inspired a series of interest rate hikes and quantitative tightening in the US, the Australian economy stagnated last year (refer to the chart below of year-on-year GDP growth). The Reserve Bank of Australia had little choice but to cut interest rates in the hope of stimulating growth.

Sources: Bloomberg, Arowana

As benchmark yields fall in Australia and remain very low elsewhere in the world, investors face the difficult challenge of finding a safe home for their capital that will provide them with an adequate rate of return.

Before we delve into these pockets of yield, it's instructive to gain some perspective on the malaise affecting the national economy.

We expect the national economy to decelerate―and to perhaps even contract―and we subscribe to the consensus view that an acceleration in growth is very unlikely over the next three years.

In a post-construction and post-resource boom world, with consumer discretionary spending at recessionary levels, all hope of a recovery in demand hinges on public expenditure and tax cuts.

It is unlikely that this fiscal stimulus will manifest in the form of significant new infrastructure projects in the near term. After all, the Coalition government's 2019 election victory was on the back of its touted fiscal discipline and a budget surplus in 2020.

It is also unlikely that China will come to the rescue of growth in Australia. In the lead-up to the GFC and its immediate aftermath, Chinese consumption, investment, and imports were a source of significant stimulus to the Australian economy. This insulated Australia from the global recession fallout. But since then, China's contribution to Australian growth has nearly halved.

Consumer spending is unlikely to support an economic rebound. The absence of growth in domestic and international demand for Australian goods and services has led non-mining corporates to focus on efficiency. This ruthless focus on costs has constricted wage growth. Consumer discretionary income is at recessionary levels despite steady unemployment. With house prices falling across most of Australia, consumer sentiment remains weak.

With these former pillars of growth now absent and unable to support the domestic economy, investors face the real prospect of a new normal of low benchmark rates of return on capital.

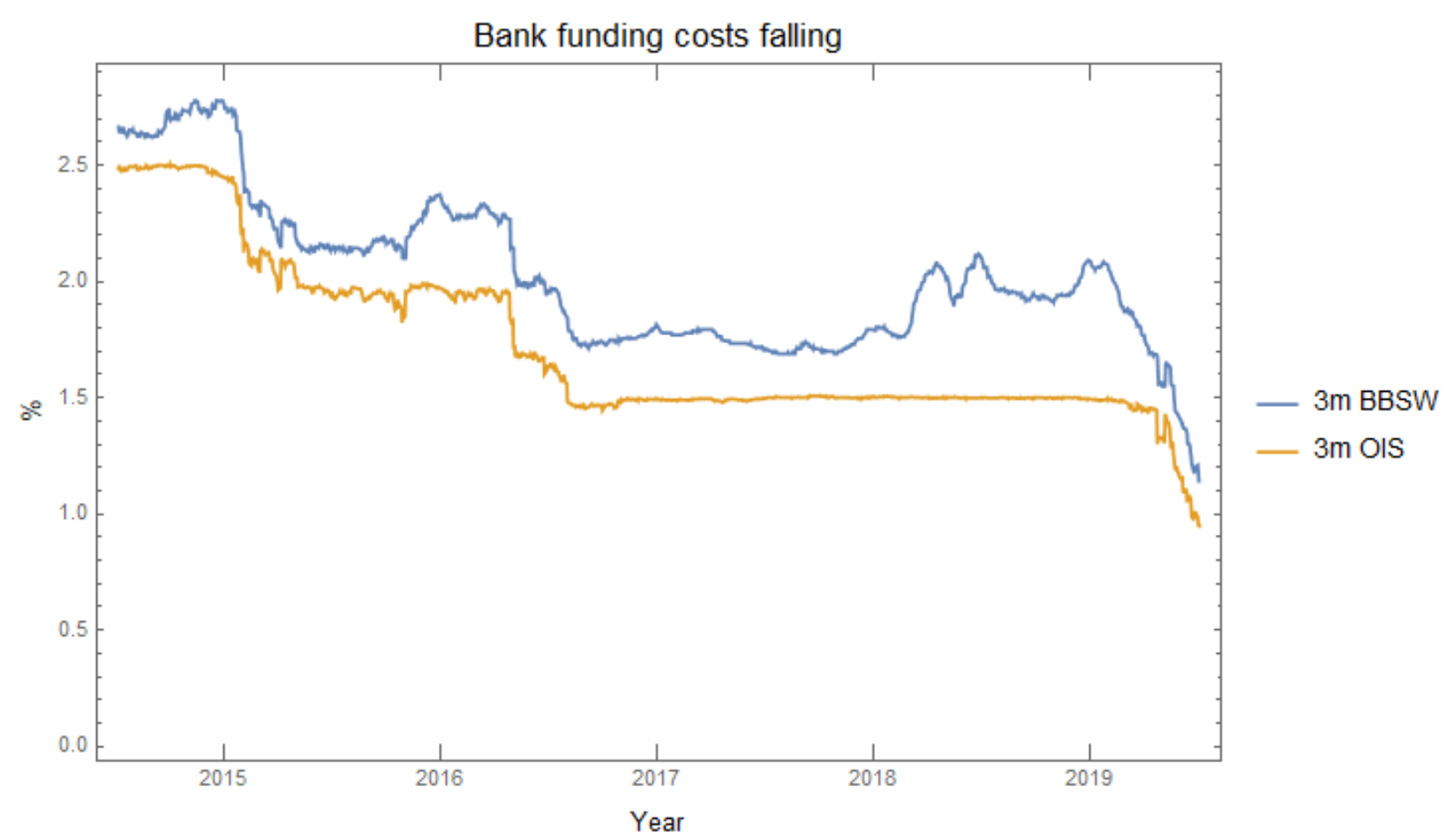

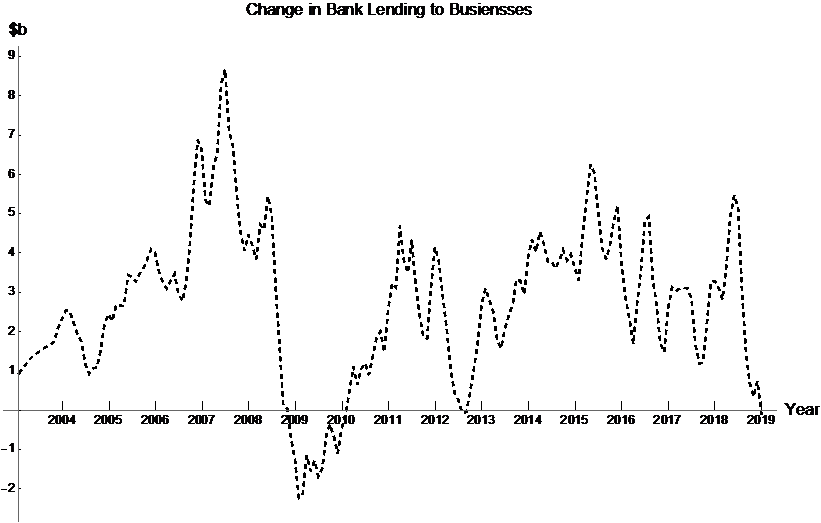

Against the backdrop of this slowing economy, bank funding costs remained high until the recent move by the RBA to cut rates. The high cost of funding and tight liquidity environment has seen the major Australian banks rationing capital to corporate borrowers.

Sources: Bloomberg, Arowana

The rate of increase in corporate funding saw its sharpest month-on-month decline since 2012 in May this year. Funding to corporates is now declining. Authorised Deposit-taking Institutions (ADIs) have been aggressive in their pursuit of reducing balance sheet exposure to this segment.

Sources: ASIC, Arowana

Capital has rotated to more Basel III capital-efficient asset classes such as residential mortgages and high credit rating-grade institutional borrowers and away from less efficient asset classes such as small private corporate borrowers.

Despite these challenges, most Corporate SMEs (CSMEs are defined here as businesses with revenues in the $20m to $50m) have not faced a particularly hostile borrowing environment yet. Our view is based on the 15 years of experience in investing in and operating SMEs and CSMEs in Australia, where anecdotally we have seen higher borrowing costs in the past than over the past 12 months. But let’s look at the evidence.

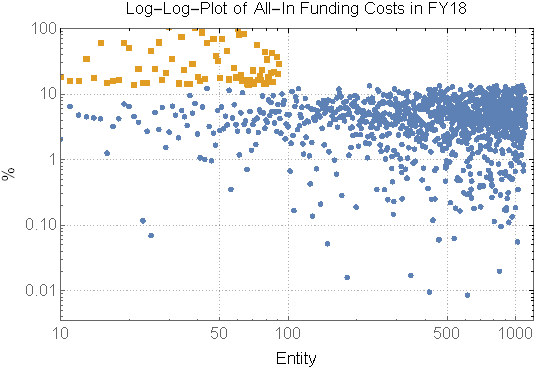

In FY18, there were two distinct classes of borrowers based on borrowing costs. The majority of CSMEs borrowed at interest rates that do not represent distressed or challenging capital market access conditions. A small cohort of borrowers did, however, pay significantly higher rates. The dot plot below visually segments these two categories. The orange dots signify borrowers that paid distressed funding rates; they were clearly in the minority.

The figure below indicates that the median borrowing cost of the clear majority (signified in blue in the chart below) of CSMEs was just under 5% whilst a small minority (orange data points in the chart below) of CSMEs paid a median rate in excess of 20%.

Sources: ASIC, Arowana

One possible reason for the continued favourable access to debt capital enjoyed by the CSMEs is that newly minted Fintech lenders―some with deposit-taking licences and 'high-yield' credit funds―are stepping into the breach left by the retreat of the major banks.

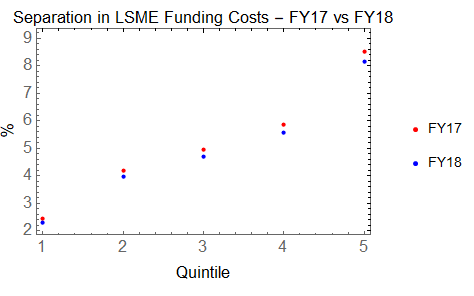

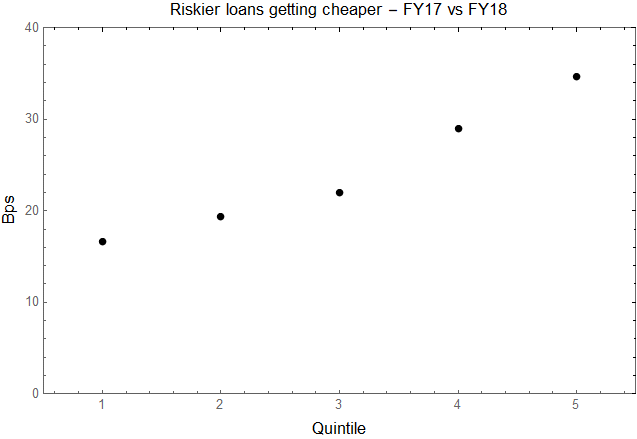

The chart below separates the funding of CSMEs into quintiles. Interestingly, it suggests that riskier borrowers have benefited the most from this disruption.

Sources: ASIC, Arowana

These high-risk borrowers have seen their funding costs fall by an average of 35bps over the FY17 and FY18 fiscal periods.

Sources: ASIC, Arowana

This calls into question the quality of assets being underwritten by these high-yield mandates and upstart Fintech disrupters.

In credit market parlance, the term ‘High-Yield’ refers to debt that is unrated and in some cases, to debt that is rated lower ‘BBB’ on the credit rating agency Standard and Poor’s rating scale.

Importantly, it is not a reference to a threshold rate of return on invested capital. So as an investor in a ‘High-Yield’ fund, you may be investing in very high-risk or distressed debt and earn low single-digit returns that don’t compensate you for the likely losses the fund will suffer as a result of investing in these high-risk assets.

To benefit from scale economies and tap into institutional debt capital markets, these high-yield mandates are sacrificing asset quality for safety in numbers. They are merely punting on the Law of Large Numbers in the hope that the asset quality of their portfolios will begin to mimic that of the broader asset class if the portfolio is large enough.

These large high-yield funds are merely aggregating debt from brokers and structured finance markets that the major banks have abandoned as too risky. What’s more, the “diversification” benefits―touted as the key mitigating factor to the risk of the underlying assets―will be of little comfort to investors in times of trouble. As we learned from the Global Financial Crisis of 2008, there is no safety in numbers for these assets, because in a downturn, the correlations of their returns rapidly converge.

Credit markets are littered with the failure of get-rich-quick strategies that try to manufacture returns in the absence of underlying cash flows. The legacy of this style of investing is the GFC that doomed the returns of almost every credit investment and those of its adjacent asset classes.

On the other hand, the fundamental credit disciplines of quantitatively and qualitatively unpacking the risks of each underlying investment and then structuring for downside scenarios, painstakingly analysing business, economic, and industry cycles, conducting primary research on both business fundamentals and capital market conditions is conducive to producing strong sustainable risk-adjusted returns that investors can bank on.

In a “Go Slow” economic environment, these two approaches to constructing high-yield portfolios are likely to have very divergent results. The temptation: to invest in asset-backed securities filled with diversified portfolios of high-risk or distressed debt, to accept very high leverage levels (leveraged loans), to forego setting covenants, to take no security, and to back businesses that would otherwise face external administration will inexorably lead to catastrophic levels of principal loss.

Credit funds that rely on heavy rotation and trading for Alpha generation carry the added vulnerability to capital loss from the volatility of credit spreads which, in a low-rate environment, have a material impact on the value of a security.

So where might investors look for sustainable returns against the backdrop of a “Go Slow” economic environment?

At Arowana, we have identified strong risk-adjusted returns in funding the revolving working capital needs of growing CSMEs with fundamentally stable underlying cash flows but have suffered a loss of liquidity because of the abrupt exit of the major banks.

As a B-Corp certified investment firm, Arowana overlays its bottom-up and top-down investment approach with an impact investing methodology that aims to assist and promote purposeful businesses to grow and flourish for the benefit of society and the environment.

These businesses create valuable assets in the form of receivables and inventory (with clearly observable market prices) and require equipment and vehicle fleets that can also be used as collateral for innovative collateralised debt facilities.

Most of these businesses have previously managed their operations to accommodate restrictive bank financial covenants yet have been unable to execute their growth mandates as a result of these constraints.

The private credit team at Arowana has developed an elegant structure that is designed to unlock the growth financing challenge for such businesses and at the same time deliver a sustainable and collateralised income yield to investors.

This article was published on Inc.com by Entrepreneurs' Organisation.

Kevin Chin, an Entrepreneurs' Organization (EO) member in London, UK and Brisbane, Australia, is the author of HyperTurnaround! and Founder and CEO of Arowana, a certified B Corporation which invests in, operates, and grows small to medium-sized enterprises. We asked Kevin how he accomplished an extreme turnaround in a tech business on the verge of collapse. Here's what he shared.

You masterminded a remarkable business turnaround, saving a tech company that had just six weeks of cash to survive, growing it exponentially in four years and ultimately selling it to Oracle. What made you decide you could successfully achieve this specific turnaround?

I felt confident that we could do so successfully because of the extent that we could drill down in due diligence, quantify quite precisely the cost savings, and map out a very detailed turnaround execution plan. In short, we were able to eliminate a lot of "unknown unknowns" and "known unknowns" before embarking on the venture. Ultimately, our game plan worked well and we exceeded the targeted cost savings plan in a shorter amount of time than budgeted, too.

However, I have since led other turnarounds that were much more difficult, including an education business that was effectively condemned by two earthquakes that destroyed its campus just months after we purchased it―yet we managed to save it and then grow it rapidly before taking it to an IPO. In that situation, it was like guerrilla warfare with a high degree of what the military calls VUCA (volatility, uncertainty, complexity, and ambiguity).

In such circumstances, it's primarily about mindset―in essence, refusing to fail. Often, in moments when you face what seems like an impossibly complex problem, peak creativity manifests. However, the prerequisite to that is the never-say-die mindset.

What top three actions did you implement to achieve the turnaround?

What is the most critical strategy to bring to turnarounds?

A mindset of flawless execution combined with meticulous planning and a strong sense of urgency. In addition, the resilience and relentlessness that are the hallmark of many fellow entrepreneurs!

What role does company culture play?

I learned firsthand during this turnaround that culture does indeed eat strategy for breakfast. With my investment banking background, I once had the mindset that business is all about the numbers and anything that cannot be quantified on a spreadsheet is a waste of time. That could not be further from reality, as numbers are the output of a strategy that is well-executed. If culture is not defined clearly by core values and cultural norms that are consistently reinforced, then it becomes very challenging to recruit and manage the right team to execute on strategy.

How did this first big turnaround affect your entrepreneurial journey?

This turnaround journey had the absolute full spectrum of entrepreneurial experiences: raising capital, taking over and privatising a listed company, executing on a mission-critical turnaround plan to save the company, acquiring bolt-on acquisitions, exponential unicorn-like global growth, fixing self-inflicted growing pain challenges, leadership musical chairs, and finally, an exit via tech-giant takeover―during the great recession. All in the space of 1,460 days (four years)!

As the saying goes, in college, you are given lessons and then tested. But in life, you are given tests and then taught lessons from them. This was certainly the case, as I learned many lessons from the experience. While there were many tough times and moments of uncertainty, I look back and am grateful for how it all unfolded. If it had been too easy, I wouldn't have learned as much I did. It gave me a very comprehensive, hands-on education in all facets of business―from sales to leadership to culture. As a result, I have become a better operator and a better investor.

Since then, our holding group has invested in and operated turnaround and scaleup missions in other businesses, across sectors such as education, asset management, solar energy, and power services. I love the entrepreneurial challenge of fixing and then growing small and medium-sized enterprises (SMEs) when the odds are seemingly stacked against you. The satisfaction comes from seeing something that was floundering, end up flourishing.

The VivoPower turnaround process continues to gather momentum, with a significant increase in the forward order book across the Aevitas business units in Australia, Kenshaw and J.A.Martin, to another new all-time record high of A$75m. This represents an increase of over 100% in a year, with expectations that this will be realised over the next 12 months.

Executive Chairman Kevin Chin noted: “The turnaround process is largely complete with respect to the Aevitas business units, and they have entered a scaling up growth phase. The growth momentum these businesses have today is pleasing, especially given that both businesses were facing declining growth and margins back in 2015. The strong growth outlook today, not just in revenue terms but also margins, is a result of a strategic pivot we initiated three years ago with a push into new markets across solar power, data centres, hospitals, and other infrastructure segments of the market. Both businesses now have a diverse and growing base of customers across different industries, with increasing repeat business from customers. In addition, the recruitment of growth-minded leaders to the business units has been key.”

In addition, Kevin said: “Separately, on the US front, VivoPower has initiated a strategic pivot with respect to the objective of maximising value of its US solar project portfolio and is executing on this strategy.”

We are pleased to announce that EdventureCo's DDLS has launched The Australian Institute of ICT (AIICT) to address the growing need for accredited IT skills in the Australian workforce.

The launch of AIICT is a further step towards the expansion strategy of DDLS to enter the consumer market, expand its product catalogue, and enter the Asia-Pacific region with its recent announced expansion into the Philippines.

The directors of AWN Holdings Limited (AWN) are pleased to announce the sale of Thermoscan, Australia’s leading independent thermal inspection service provider to ARA Group Limited (ARA) for $6M. This represents a $3.4m profit on book carrying value and a multiple of invested capital (MOIC) of 3.8x.

ARA is one of Australia’s largest building and facility management services firms with annual turnover of $479M. ARA employs over 2,000 skilled people across 40+ offices in Australia and New Zealand.

We have owned Thermoscan since 2011 and it has delivered strong investment returns, both from an annual dividend income and capital gain perspective. Much of this is due to the efforts of Kelly Alcorn, Thermoscan’s General Manager. For those who do not know, Kelly joined Thermoscan as a part-time bookkeeper and through her hard work and commitment took over as GM in 2015. She has also been a strong proponent of Rockefeller Habits and ScalingUp, which has delivered results for Thermoscan year after year.

Kelly Alcorn, Thermoscan’s General Manager, commented: “We are looking forward to being part of the ARA Group and know that Thermoscan will be a great strategic fit. I would also like to thank Kevin, Michael, and the rest of the Arowana team for their guidance, mentorship, and support over the years.” This was one of our key objectives for this financial year and we are very pleased, as it not only delivers a better-than-expected outcome but also more importantly, provides a great platform for Kelly and her team to further scale the Thermoscan business.

We are pleased to announce that DDLS has entered into an agreement with a wholly-owned subsidiary of Aboitiz Equity Ventures (AEV) to roll out DDLS's platform of professional information and communications technology seminars across the Philippines.

AEV, one of the largest business conglomerates in the Philippines, is the Aboitiz group’s listed holding company. With a market capitalisation exceeding A$8.8billion as of 12 March 2019, AEV operates businesses in: (i) power generation, distribution, and retail electricity supply; (ii) banking and financial services; (iii) food manufacturing; (iv) real estate development; (v) infrastructure; and (vi) portfolio investment.

We are pleased to announce that DDLS will commence delivery of Amazon Web Services (AWS)-accredited training from February 2019 across all DDLS centres in Australia.

With the addition of AWS alongside Microsoft and Google, DDLS will be the only IT training provider in Australia to offer training in all three Gartner Magic Quadrant leading cloud providers.

For more information, click through to the DDLS press release.

We are pleased to announce that DDLS Australia Pty Ltd, a wholly-owned subsidiary of AWN, has been appointed by Cloudera―the modern platform for machine learning and analytics optimised for the cloud―as its major training partner in Australia.

DDLS will commence delivering Cloudera courses across a national schedule from 18 February 2019, commencing with Cloudera’s three most popular courses for Administrators, Developers, and Analysts.

Please refer to the attachment for further details regarding the partnership.

Megatrends are those shifts so significant that they shape our businesses, our economies, and our lives. Depending on the industry in which our business operates in, the impact of these megatrends will vary. It doesn't have to be negative but being aware of these trends will enable us to think about how we can create opportunities for our businesses.

Having an insight into these megatrends will enable us to form a future-proofing strategy for our business. The digitisation megatrend is one obvious example of recent years, but what are the upcoming trends business leaders should be aware of, and what are their likely impacts for businesses?

What are global megatrends?

Megatrends could be understood as major, sustained global shifts that impact individuals, businesses, societies, economies, and cultures. They're "mega" because they're significant enough to define our way of living and doing business.

Observations on megatrends and what to prepare for

Understanding the biggest megatrends facing businesses today is critical to future-proofing our businesses and investments.

At Arowana, we see these five megatrends as ones that are already impacting economies around the world and will continue to do so for some time.

1. Electrification of society fuelled by battery storage

One of the most significant megatrends is the rise of solar energy fuelled even more by the emergence of battery storage. Further improvements made in battery technology will continue to aid the growth and adoption of renewable energy as well as electric vehicles.

Business owners should explore and consider how trends like the electrification of transport, could help your business as well as opportunities that could emerge from the decentralisation of power generation aided by battery storage.

Perhaps your margins are being impacted by peak power prices? Installing solar and battery storage on-site may be an option to reduce these cost pressures, allowing your business to soak up the sun’s energy during the day with additional backup power supply from the installed battery which could be charged-up during offpeak periods.

Arowana through its 61%-owned subsidiary, VivoPower, has completed projects representing more than 90 MW of generation capacity over the past two years and has an established track record in the utility-scale sector. In September 2018, VivoPower announced a new partnership with IT Power (Australia) Pty Ltd to develop a portfolio of utility-scale ground- mounted solar projects in New South Wales.

Additionally, VivoPower's wholly-owned subsidiary, Aevitas Group Limited, won the contract to design and construct the 3.6 MW Cubbie Solar Project for the largest cotton producer in Australia. Once complete, it will help power 40% of Cubbie’s energy needs during the peak cotton ginning season.

2. The middle class in Asian emerging markets

The middle class continues to expand the vibrant economies of Asia and Arowana views e-commerce and education as two ways for business leaders to leverage this megatrend.

Asian emerging economies account for approximately 44% of global GDP, which today amounts to US$28.79 trillion. This number is predicted to continue growing by over 5%p.a. over the next year. In our opinion, the rising middle class in Asia continues to grow and is leading a boom in e-commerce. For 2018, e-commerce revenues for the region amounted to US$832m compared to the US which was US$505m. Majority of e-commerce buyers tend to be under 35 years of age, with the 24–34-year-olds being the largest group of buyers. This is significant given the youthful demographics of the Asian region and it is predicted that revenues in the Asian e-commerce market will grow by 10.5% annually over the next five years.

In terms of education, Arowana is already actively engaged in the Asian emerging markets with our education platform, EdventureCo. We're currently working on bringing Australia's largest ICT training provider DDLS to the Philippines, one of the fastest-growing economies in the world, with a population of over 100 million and a youthful median age of under 25. The country has committed to innovation and digital transformation to future-proof jobs and address skills gaps. Key industries and skills in demand include knowledge and business process outsourcing, big data, data analytics, cybersecurity, blockchain, digital commerce, and fintech. And this partnership in the Philippines is only the beginning of DDLS’s plans to address the skills gap issue prevalent in workforces around the globe.

3. Automation and robotics essential to survival

Artificial intelligence (AI), automation, machine learning, and robotics are no longer the stuff of science fiction. Instead, they're opportunities for business leaders to transform their business models. Businesses that ignore AI and machine learning will not survive in the coming decades.

Using automation and robotics in business has a range of benefits, as it can speed up everyday business processes by automating and streamlining them. AI can also be used to improve customer service online, and this allows businesses to allocate their resources more efficiently and effectively. Businesses should take a good look at their processes to determine at what points AI or robotics could be implemented for the greatest benefits.

All types of businesses are employing more data analytics, automation, and robotics into their everyday transactions and this is becoming the norm where pizza delivery now employs more data analysts than pizza delivery drivers. It’s not just pizzas but burgers too. The outcome of this is a more consistent and price-competitive product, plus pizzas arrive as hot as they were baked―on delivery.

Arowana has built up its knowledge base and capabilities in artificial intelligence, including data analytics. We draw upon the expertise of Prof. Hugh Durrant-Whyte, our advisory board member. A renowned expert in robotics, automation, machine, and deep learning as well as data science, Prof. Durrant-Whyte is an early pioneer of various localisation, mapping, and automation technologies and has helped companies like Rio Tinto develop the autonomous mining truck. He was also the Chief Scientific Advisor for the UK Ministry of Defence.

We also call upon the expertise of Ed Fernandez, a director on our board. Ed is an experienced Silicon Valley venture capitalist and technology entrepreneur in the field of machine learning and AI. Trained in electrical and electronics engineering, Ed is an active investor in and advisor to various startups, and runs Naiss.io, a venture capital and advisory boutique in Palo Alto.

Arowana has applied AI and machine learning techniques in acquisition due diligence as well as implementing it within our operating companies, such as EdventureCo and Thermoscan. We are committed to growing our team with future hires of data scientists, experienced AI technicians, and machine learning engineers to help future-proof our operating companies.

4. Cybersecurity and data protection focus to increase

Arowana identifies cybersecurity and data protection as a megatrend for the long term. We should expect exponential increases in cyberattacks and data theft in addition to a chronic shortage of cybersecurity and data protection professionals. Business leaders, depending on their sector, could target gaps in the marketplace for these products and services. It's also vital to stay up to date with regulatory obligations, compliance, and measures for safeguarding your business and data.

Business data that’s at risk from cyberattacks include customer information, financial records, business plans, intellectual property, and employee records. In order to protect such data from cyberattacks, businesses should develop clear policies for security measures, implement new security procedures, and keep all computer systems updated with the most recent software protection.

Cyberattacks will continue to increase and no one is safe―not even the Prime Minister of Singapore―whose health records were targeted by malicious attackers. If you're concerned about data security, you can check if your email account has been compromised at this website.

Arowana is well-positioned in this area, with EdventureCo's DDLS recently recognised as the top global provider of cybersecurity training by the EC-Council. The EC-Council (International Council of E-Commerce Consultants) is the world's largest cybersecurity technical certification body. DDLS has partnered with EC-Council to deliver training in cybersecurity courses in Australia.

5. Rise of medical cannabis, and decline in alcohol and sugar

Arowana notes that a multi-decade decline in alcohol and sugar consumption has commenced. With this, the push to decriminalise and legalise medical cannabis across the world―even in unlikely countries like Thailand and Malaysia, for example―will drive exponential growth and disrupt multiple sectors. For the entrepreneurs amongst us and business leaders, you may want to consider the likely opportunities as well as challenges―such as competition from medical cannabis companies and associated businesses―could inform their future-proofing strategies. One such company, Altria, the maker of Marlboro cigarettes, has recently made a US$1.8bln investment into cannabis producer, Cronos.

The younger generations are choosing better alternatives to alcohol for socialising, and so they arere drinking far less than they used to. Alcohol consumption is dropping, with consumers focussing on quality and spending more, opting for premium beverages.

Similarly, sugar consumption is also on the decline as soaring obesity rates hit extreme heights and awareness of health risks associated with too much sugar grows. Perhaps the dedicated work of our fellow Aussies, such as Sarah Wilson's I Quit Sugar and Damon Gameau’s That Sugar Film, are finally being heard. However, individuals with interests to protect will continue fighting against this trend, such as the CEO of Coca-Cola Amatil. In arguing against a sugar tax.

Is your business prepared for the future?

We hope this article has been useful and you take the opportunity to plan for the megatrends set to disrupt our businesses and societies. Technology-driven trends like cyberattack risks, automation and AI, and electrification have a broad impact across sectors. Other trends like the rising middle class in Asia and the legalisation of medicinal cannabis could present opportunities for nimble businesses seeking new market opportunities.

Are you interested in finding out more about Arowana and how SMEs can future-proof their business? Visit our website and get in touch with us: https://arowanaco.com/connect/

Meet Ceilidh O’Sullivan. She is a young woman whose curiosity for how homes were built and her determination to pursue a career in building and construction led her to Everthought Education, Arowana’s building and construction college. Proudly, she now has her carpentry license and is certified to be a site supervisor. But Ceilidh’s aspirations are higher. She wants to be a Building Designer and is continuing her studies while working part-time.

As a “Lady Tradie”, the fact that the industry is male-dominated was only a part of the challenges she faced. The biggest one for Ceilidh was that she is deaf. This could have been an obstacle on the learning front, but with the help of Everthought, Ceilidh was able to pursue her goal. With support from Everthought’s trainers and the flexibility of an online course, Ceilidh was given guidance and feedback about her career choices. She is now well on her way towards achieving her goals and we applaud her for her desire, her ability, and her tenacity in motivating herself to the fulfil her ambition.

Stories like Ceilidh’s helps the Arowana Team realise that what we do really matters and has an impact on others. From the outset, Arowana has been in the business of operating and scaling up small-to-medium sized businesses (SMEs) which are the backbone of any economy. Our aim is to find businesses that serve a real purpose within their industries and in society who need our support to manoeuvre into sustained growth. Arowana’s other operating companies are focussed on solar energy and thermal safety inspections.

Arowana founded VivoPower in 2014, a global solar development group that has since successfully developed and operated utility-scale solar farms in the US, generating 91 MW of power that is delivered to over 21,000 homes and offsetting approximately 59,500 tonnes of CO2 emissions every year. In addition, rather than sending slightly damaged but operational solar panels to landfill, VivoPower created an initiative for a low-income community solar farm comprising of 2 MW of solar power. The electricity revenues from this initiative will be used to make the project self-sustaining on an ongoing basis and to offset 100% of the electricity needs for 100 very low-income homeowners.

When Arowana acquired Thermoscan, a 30-year-old safety and electrical failure prevention business, from its terminally ill founder, his wish was to see his legacy grow. Arowana transformed Thermoscan from a paper-based business into an interactive database-driven system, digitising paper-based working processes. This enabled technicians to operate more effectively, increased the number of sites inspected, and reduced the number of potential catastrophic events occurring.

At Arowana we believe that if we grow our people, we will grow our companies, and we will grow value for all our stakeholders. Internally, we have set up the Arowana University that provides training and development for our team. We recently appointed Dr Tara Swart as Arowana’s Chief Neuroscience Officer to help us be more mindful in our daily lives and to help us perform more sustainably.

To solidify our purpose in society, Arowana became a certified B Corp in May 2018. B Corps are for-profit companies that have met B-Lab's rigorous standards of social and environmental performance, accountability, and transparency. There was no doubt the assessment was comprehensive. Most importantly, the assessment was a useful guide which enabled us to evaluate our total societal impact (TSI), and now offers us the opportunity to improve our TSI as our journey continues.

For too long, environmental and social issues have been relegated to government policy makers and NGOs to deal with. But today, we live in a world that is far more aware and socially attuned to these issues. Everyday consumers and investors alike are consciously and purposefully making choices that are linked not just to their needs but to the societal impact that is achieved: How is the company that I am doing business with creating a positive impact? How are they protecting the environment? How are they improving employability and financial inclusion?

Additionally, as pointed out by the Boston Consulting Group, when companies adopt a lens that focusses on total societal impact when setting strategy, they will reduce the risk of significant negative events and open up valuable new opportunities and increase corporate longevity. Arowana has a long-term commitment to help future-proof our businesses so that we can continue to serve not only within the industries we operate but in society as well.