Global interest rates are very nearly zero and likely to stay low for the foreseeable future, according to the Chairman of the US Federal Reserve: “We are in a world of much lower interest rates, and I think it’s driven by long-run structural things and there is not a lot of reason to think that will change” – Jerome Powell, November 2019, Testimony before Congress on the US economy.

This prolonged low-rate environment and the accompanying adverse impact of low cash yields on lifestyle are forcing investors into assets that carry a higher level of risk.

So, what solutions to this yield dilemma does the Australian fixed income universe offer?

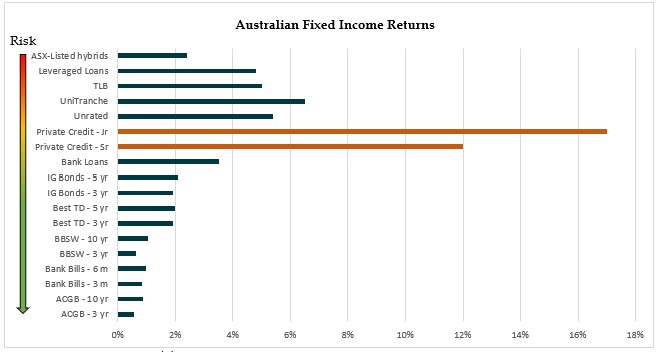

The chart below plots risk–reward characteristics of a broad spectrum of Australian fixed income investments. This discussion will focus on hybrid debt, leveraged finance, and private credit since they offer attractive rates of return relative to low cash like returns of the remaining debt categories.

At the most equity-like end of the spectrum, investors will encounter hybrid assets. The majority of these are issued by the regulated banks to meet ever-increasing regulatory Total Loss Absorption Capacity (TLAC) requirements.

Hybrids: Cheap Equity?

In July 2019, APRA confirmed―after releasing a discussion paper on the subject in 2018―that it “will require the major banks to lift Total Capital by three percentage points of [Risk Weighted Assets] RWA by 1 January 2024. APRA “expects the issuance of an additional three percent of RWA in Tier 2 instruments can be achieved in an orderly manner, and be maintained through varied market conditions.”

This means that over the next three to four years, investors should expect the volume of “loss-absorbing” instrument issuance in the form of Tier 2 hybrids to increase and to therefore “dilute” the value of these investments. These instruments are designated by the regulator to be near-equity equivalent capital that would be converted into equity at the regulator’s behest―likely at the first sign of domestic or global economic and financial system stress―to insulate the local financial and payment system.

They may have a preferred status over equity, but the veil that separates these instruments from the bottom of the capital structure is miniscule. To the banks, this is a cheap form of near-equity capital.

Leveraged Loans: CLOs are back in vogue

Leveraged loans―or are loans that either add to or result in borrowers carrying significant levels of debt―have expanded rapidly in recent years, especially in the US. Annual leveraged loan issuance in America has increased from US$100b in 2009 to $600b in 2018 [1] thanks to the abundance of cheap liquidity. Not surprisingly, the credit quality of these loans has concurrently weakened with leverage levels creeping from 3x-4x in 2009 to the pre-Global Financial Crisis levels of 6x-7x EBITDA (earnings before interest and tax)[2] and covenant protections have been eroded.

The situation in US markets is dire. A large swatch (55%-60%) of outstanding leveraged debt in the US is packaged into “collateralised loan obligations” or CLOs by private-equity firms, hedge funds, and others that slice up the loans and sell it to investors at significant premiums. According to S&P Global Market Intelligence, over a third of leveraged loans refinance existing debt whilst the share of outstanding loans rated in the very risky ‘CCC+’ category has risen sharply[3]. This debt is not for growth funding―it’s just to kick the refinancing can just a little further down the road. In fact, a large component of the original debt emanates from merger and buyout funding and to pay private-equity firms’ dividends.

Private Credit: a sustainable yield payer

Regulated banks in Australia ascribe a 2% probability of loss[4] to their loans to small business[5] compared to 1% for residential mortgages. Thus, a rational investor would expect to earn at least twice the rate of return on a small business loan as they would on a residential mortgage.

But this is far from the case in Australia. While the three-year standard variable rate of a residential mortgage loan costs around 3%, expect to earn between 6% and 12% on senior secured business loans and over 16% on unsecured business loans.

So why is this debt so attractively priced for investors on a risk-adjusted return basis? One reason is that it’s a market that has traditionally been serviced exclusively by the banks. Recently imposed higher regulatory capital risk weightage towards corporate loans has prompted a rapid withdrawal of bank-lending to this sector, leaving a void that is being filled by alternate lenders. The shortage of capital supplied to the segment has resulted in a spike in yields.

Why are these yields sustainable?

The moat that restricts the supply of capital flow to this asset is the relative difficulty of originating and structuring transactions and assessing the credit worthiness of these borrowers relative to the level of fees available to pay for the requisite level of diligence due to the smaller deal sizes associated with this segment of the market.

The concentration of banking in Australia supported the banks’ profitability of small business lending through the sheer scale of operations. That profitability has now been swept away by the increase in relative regulatory capital weighting.

[1] Economist, What are leveraged loans?, 11th Jan 2019.

[2] S&P, Leverage on US LBOs Hits Highest Level Since Financial Crisis, 3rd October 2017. S&P, Leverage Creep: With EBITDA Adjustments/Synergies, Risky Loans Grow Riskier, 23rd October 2018. S&P, as leveraged loan downgrades mount, CLOs cast wary eye on triple-C limits, 1st November 2019

[3] Ibid

[4] Connolly and Jackman, “The Availability of Business Finance”, RBA December Quarter 2017

[5] The SME categories in APRA’s capital framework include businesses that have reported consolidated annual sales of less than $50m