Our fifth anniversary as an LIC

The year ended 31 December 2019 marks the five-year anniversary of the Arowana being listed on the ASX. However, the Arowana Contrarian Value Fund (formerly the Arowana Australasian Value Opportunities Fund) was actually founded 10 years ago.

In the five years prior to its IPO, an audited ungeared return of 142.6% was achieved, representing an outperformance of 73.6% over the ASX/S&P 200 Accumulation Index which delivered a 69.0% return over the same period.

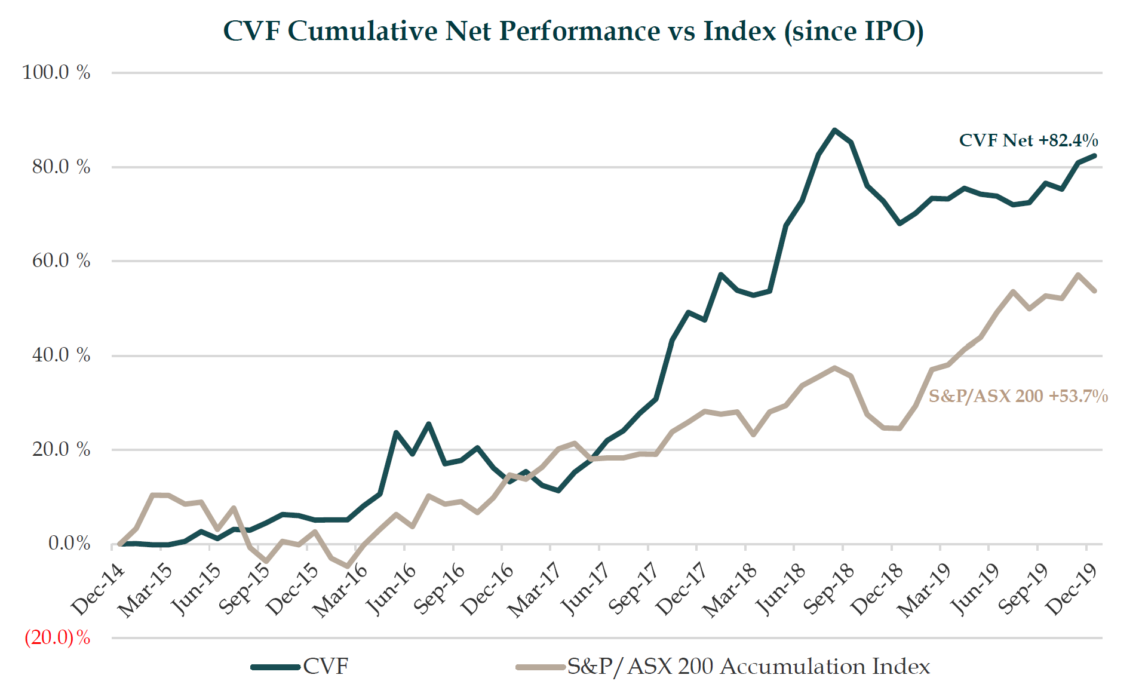

Since its IPO, CVF has returned 82.4% (12.8% annualised), outperforming the ASX S&P 200 Accumulation Index by 28.7%. We are pleased that the Fund has delivered outperformance during this time and over the last three years is in the top quartile of equity LICs on the ASX1, despite having no gearing and maintaining an average cash balance of 57.0%.

We look forward to continuing to deliver excellent value to our shareholders in the future and thank you for your ongoing support.

*The company is required to estimate the tax that may arise should the entire portfolio be disposed of on the above date and show the result per share after deducting this theoretical provision. Any such tax would generate franking credits, whose value would not be lost but rather transferred to shareholders on payment of franked dividends.

1 Source: ASX Investment Products. Included are only LICs that report three-year performance and have a market cap of >$30m. Performance data is three years to November 2019.