On the 27th of August 2020, the Federal Open Market Committee (FOMC) released an update to its Statement on Longer-Run Goals and Monetary Policy Strategy. The update signalled a fundamental shift in the focus of US monetary policy to job creation and away from its traditional obsession with inflation.

The updated monetary policy framework relegates the former 2% inflation upper-bound to a supporting role with greater emphasis now placed on stimulating the economy as needed and signalling the tolerance for inflation in the short-run: “appropriate monetary policy will likely aim to achieve inflation moderately above 2% for some time.”

How will this new direction and focus of the US central bank play out over the next five years? What are some of the underlying motivations and drivers of this policy shift? To answer these questions, perhaps it is instructive to examine the evolution of recent economic history because it serves as an important contextual backdrop to contemporary policy formulation.

During the Great Depression of the 1930s and its immediate aftermath, there were two conflicting theories that aimed to explain its cause. On the one hand, economists of the “classical” school that subscribed to more liberal ideology pointed to government overreach and expansive government monetary policy for causing an asset bubble. On the other hand, John Maynard Keynes in his “General Theory” (1936), refuted these claims and postulated that it was the “animal spirits” of free-market capitalists that was to blame—which translates to the stern admonishment of following the “greed is good” philosophy of Gordon Gekko types (from the 2015 movie, Wall Street).

The classical school, comprising of thinkers such as Adam Smith, advocated minimal government intervention and attributed the stability of this system of liberalised economy to the convolution and eventual coalescing of aggregate human self-interest. In The Wealth of Nations (1776), Smith claimed that it was an “invisible hand” that “directed individuals and firms to work toward the public good as an unintended consequence of efforts to maximise their own gain.”

The Keynesian postulation was that aggregate demand was a function of capital investment and consumption by government and the people. The volatility of the stock market and the subsequent real economic impacts were a consequence of the evaporation of private investment due to the irrational, fear-driven decision-making of investors.

From this Keynesian perspective, fiscal intervention was essential to maintaining full employment. This insight served as a catalyst for a metamorphosis of the form of liberalism that dominated American politics.

Beginning with Franklin D. Roosevelt’s New Deal, the focus of this new brand of liberalism shifted from producers (the supply side) to consumers (the demand side). As Arthur Schlesinger, Jr. opined in Liberalism in America: A Note for Europeans (1962): “When the growing complexity of industrial conditions required increasing government intervention in order to assure more equal opportunities, the liberal tradition, faithful to the goal rather than to the dogma, altered its view of the state. […] There emerged the conception of a social welfare state, in which the national government had the express obligation to maintain high levels of employment in the economy, to supervise standards of life and labour, to regulate the methods of business competition, and to establish comprehensive patterns of social security.”

Milton Friedman and Anna Schwartz came to a separate conclusion about a possible cause of the Great Depression. In their book, A Modern History of the United States 1867–1960 (1963), they argued that it was the failure of the central bank—the Federal Reserve—that led to the stubbornly high unemployment that followed the stock market crash of the 1930s.

By sanctioning the failure of banks to stem the run-on cash, the Federal Reserve had orchestrated a catastrophic evaporation of liquidity through a reversal of the multiplier effect.

Friedman and Anna Schwartz concluded that it was the resulting material reduction in the supply of money and velocity of money that stifled aggregate demand and entrenched high levels of unemployment. We know from the Global Financial Crisis of 2008 that a similar pattern of financial institution failures—partly enacted by central governments in a reflexive protectionism of their own economies—contributed to the temporary collapse of the global financial system, giving rise to tsunamis of disastrous consequences for the real economy in the decade that followed.

Central Bankers of past decades such Paul Volcker and Ben Bernanke incorporated Friedman and Schwartz’s findings into modern-day central banking where central banks played a vital role in providing stability to the real economy through shocks to the financial or real economy. Public enemy number one according to these central bankers was inflation.

As Paul Volcker wrote in Keeping At It: The Quest for Sound Money and Good Government , his book co-authored by Christine Harper (2018): “A remarkable consensus has developed among modern central bankers … that there’s a new ’red line’ for policy: a 2 percent rate of increase in some carefully designed consumer price index is acceptable, even desirable, and at the same time provides a limit. I puzzle at the rationale. A 2 percent target, or limit, was not in my textbooks [a] year ago. I know of no theoretical justification.”

In his speech at the University of Chicago in 2002, Ben Bernanke said, “For practical central bankers, among which I now count myself, Friedman and Schwartz’s analysis leaves many lessons. What I take from their work is the idea that monetary forces, particularly if unleashed in a destabilizing direction, can be extremely powerful. The best thing that central bankers can do for the world is to avoid such crises by providing the economy with, in Milton Friedman’s words, a ‘stable monetary background’―for example, as reflected in low and stable inflation.”

But, as noted in the FOMC update of its Monetary Policy Strategy on the 27th of August 2020: the current preoccupation of the Federal Reserve is with driving down unemployment which leaves the door ajar to inflation.

With the monetary policy now hitched to the fiscal engine courtesy of the updated Monetary Policy Framework, the US has created a blueprint for central governments to set into motion debt-funded stimulus programs to revive a real-economy suffering from intrinsic or extrinsic shocks. The central banker’s role is to monetise this debt and keep interest-rates low using tools such as Quantitative Easing (QE).

But maintaining low interest-rates over a long period may give rise to unanticipated disinflation or deflation—through the Fisher effect (courtesy of Irving Fisher)—which could redistribute wealth to lenders and away from borrowers and disincentivise investment. This could lead to an upward spiral of government debt as debt-funded stimulus becomes necessary to support aggregate demand which has been the case in Japan over the past several decades.

So how does a central government go about repaying its debt? Three possible options it may consider are default, austerity, and inflation. The first two options are politically unsavoury whilst inflation can not only support government debt reduction but also redistribute wealth away from wealthy savers to those in debt—and more importantly, those willing to spend and consume.

But as discussed above, and has been the case in Japan, creating reserves in the central banking system does not translate to increased money supply. In other words, providing banks with liquidity does not necessarily translate to them adding to money supply by making loans.

Now what if the government could direct the banks to make loans and central banks could directly inject capital into debt markets by bypassing the banks? This would collectively have the desired effect of boosting money supply and—if the velocity of money and real GDP remained constant—it would drive up inflation. Welcome to the world of politicised credit and financial repression.

Beyond the control of banks (disintermediated capital flow), policymakers may wrest control from private and traded debt capital markets. The tools used in these interventions may range from the direct purchase of corporate credit as has been done in the US to the formation of sovereign loan funds—perhaps managed by the private sector—but with mandate restrictions that ensure that investment activity is aligned with the broader objective of employment creation.

In this new world order, in contrast to that described by free-market capitalism, government would direct and control the flow of capital. Employment, wealth equality, and wealth creation are objectives for the economy that are aligned with government’s incentive to win votes.

With the focus on job creation, capital flow, fiscal and monetary incentives, deregulation, and the dismantling of competitive moats would be showered on segments of the economy that provide the greatest opportunity for employment. These segments will differ from country to country. In Australia, for instance, the SME sector employs 44% of the country’s workforce (Australian Small Business and Family Enterprise Ombudsman (2019), Small Business Counts) and has been targeted through both Fiscal and Monetary policy intervention with banks being provided with government guarantees for loans to eligible companies and the Reserve Bank of Australia offering banks a subsidised funding facility to lend to small business in a manner similar to initiatives taken by the Bank of England.

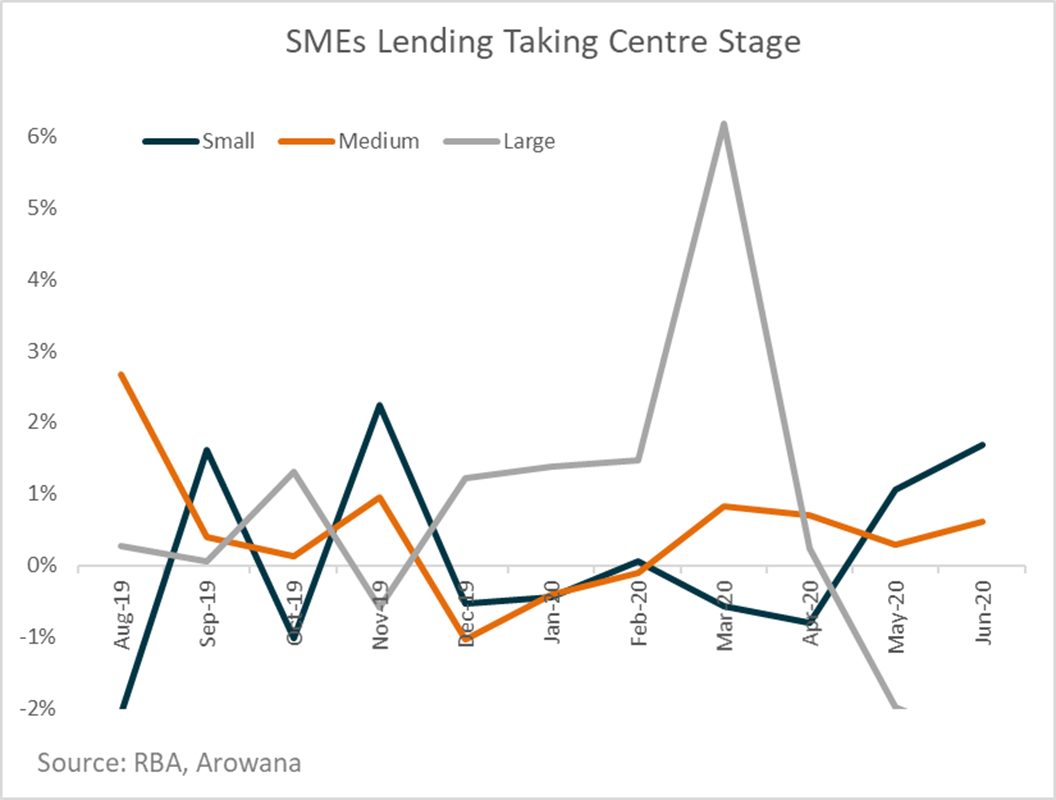

This chart of the rate of growth in lending to small, medium, and large business highlights the shift in debt capital flows to Small and Medium Enterprises (SMEs) in Australia.

The losers—from this deviation from liberalism—would be businesses that offer low incremental new jobs per unit of leverage—i.e., large business (refer to the chart above), banks, speculators, and savers.

With the prioritisation of consumption and employment, speculators that seek to leverage cash flows would be starved of capital. Savers would see the monetary value of their savings eroded by negative real rates of return with the banks being sanctioned to reduce deposit rates to conserve net interest margins and capital buffers.

Banks would be subject to government-directed lending in a low-interest-rate environment with the combined profit-corrosive forces of contracting net interest margins and rising credit provisions.

Large business would see competitive moats eroded and a narrowing of comparative funding access with SMEs.

Overall, saving is contractionary to an economy, and you will no longer be rewarded for it whilst credit will flow, and the cost of debt will be low.

I, for one, plan to go out and SPEND!