There is unquestionable interest surrounding the production and sale of non-fungible tokens (NFTs). An NFT is a digital asset that represents ownership in real-world objects (these can vary from art to music, etc.). A recent sale of the artwork, “Everydays: The first 5000 days” for $69m made news headlines. NFTs are produced on the Ethereum blockchain, and among other criticisms, these are notorious for their significant energy consumption. In fact, the production of one NFT (inclusive of minting, bidding, selling, etc.) is purported to require ~369 kWh of electricity.

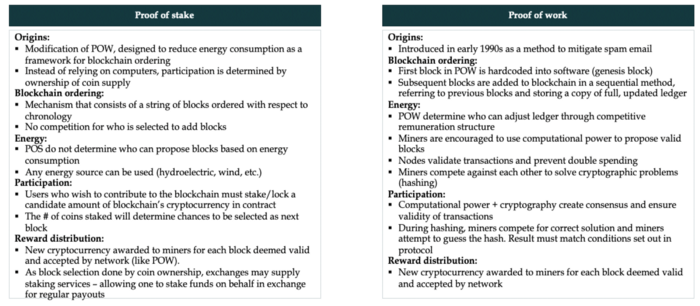

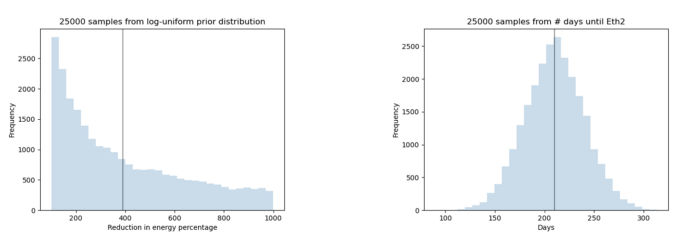

However, the landscape is set to change imminently. Ethereum 1.0 is in the process of transitioning to Ethereum 2.0 (Eth2) in Q1/Q2 2022, and in doing so, will move from a Proof-of-Work (POW) to a Proof-of-Stake (POS) consensus system. This transition means that the energy requirements are estimated to drop somewhere in the order of 100x to 10,000x, although we believe that the former is indeed more likely. Accordingly, NFTs are likely to reduce their environmental impact quite significantly. But how great will this reduction be? Given the uncertainty in many of our model parameters, this is a difficult metric to quantify, and one should account for uncertainty in parameter values, as well as the interplay of such parameters.

In this note, we seek to:

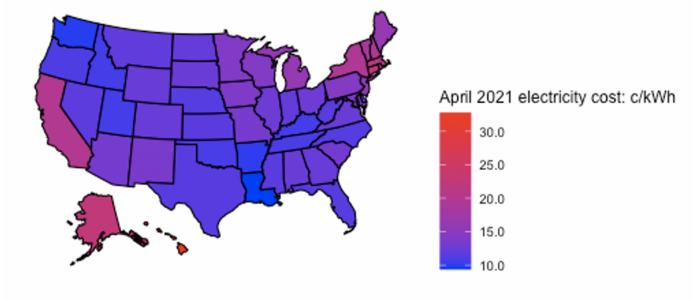

As of April 2021, the average price a residential customer in the US would pay for electricity is ~ 13.31 cents/kWh. However, there is significant variability in electricity costs over time, and perhaps more importantly, there is pronounced variability in the cost of electricity between states. The state with the lowest electricity rate is Louisiana, paying an average of 9.53 cents/kWh. Below, we display the spatial distribution of electricity costs across the country.

Ethereum 2.0 refers to a collection of upgrades that are designed to enhance the scalability, security, and sustainability of the Ethereum platform. The vision includes:

The table below outlines the key differences between the POS and POW consensus protocol methodologies.

When considering the cost of NFT production over the proceeding year, one notices that it is a function of several parameters, namely:

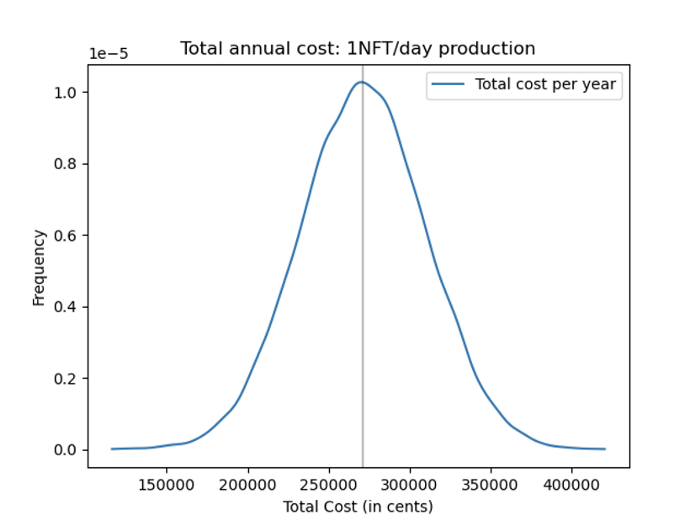

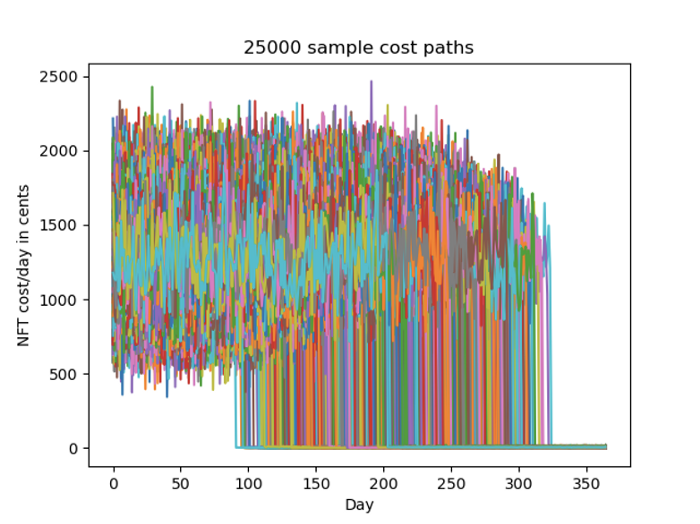

To explore the most probable cost of NFT production over the proceeding year, we design a simulation framework to study the distribution of NFT cost paths. To account for the uncertainty in aforementioned variables 1–4, we treat key parameters as random variables and run 25,000 simulations to explore the distribution of possible scenarios. Given the uncertainty in our parameters, we make the following assumptions regarding model parameters:

One can see the most probable parameter values for (1) # days until Ethereum 2.0 activation and (2) the magnitude of the reduction in electricity production after the transition below:

The simulation procedure integrates over a range of possible scenarios, taking account of their interactions, and producing paths of NFT costs. The sharp reduction in costs (with varying magnitudes) most prominently reflects the timing and impact of the switch to Ethereum 2.0.

Our simulation procedure suggests that, for one concerned with the electricity cost of producing 1 NFT per day for the proceeding year, it will likely cost ~ $2,715. One should note that this result is highly dependent on the underlying model assumptions, and should one have strong prior beliefs regarding parameter values, the simulation can easily be adjusted to account for this.