There is unquestionable interest surrounding the production and sale of non-fungible tokens (NFTs). An NFT is a digital asset that represents ownership in real-world objects (these can vary from art to music, etc.). A recent sale of the artwork, “Everydays: The first 5000 days” for $69m made news headlines. NFTs are produced on the Ethereum blockchain, and among other criticisms, these are notorious for their significant energy consumption. In fact, the production of one NFT (inclusive of minting, bidding, selling, etc.) is purported to require ~369 kWh of electricity.

However, the landscape is set to change imminently. Ethereum 1.0 is in the process of transitioning to Ethereum 2.0 (Eth2) in Q1/Q2 2022, and in doing so, will move from a Proof-of-Work (POW) to a Proof-of-Stake (POS) consensus system. This transition means that the energy requirements are estimated to drop somewhere in the order of 100x to 10,000x, although we believe that the former is indeed more likely. Accordingly, NFTs are likely to reduce their environmental impact quite significantly. But how great will this reduction be? Given the uncertainty in many of our model parameters, this is a difficult metric to quantify, and one should account for uncertainty in parameter values, as well as the interplay of such parameters.

In this note, we seek to:

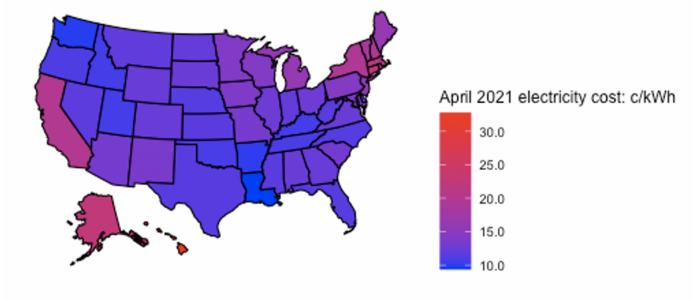

As of April 2021, the average price a residential customer in the US would pay for electricity is ~ 13.31 cents/kWh. However, there is significant variability in electricity costs over time, and perhaps more importantly, there is pronounced variability in the cost of electricity between states. The state with the lowest electricity rate is Louisiana, paying an average of 9.53 cents/kWh. Below, we display the spatial distribution of electricity costs across the country.

Ethereum 2.0 refers to a collection of upgrades that are designed to enhance the scalability, security, and sustainability of the Ethereum platform. The vision includes:

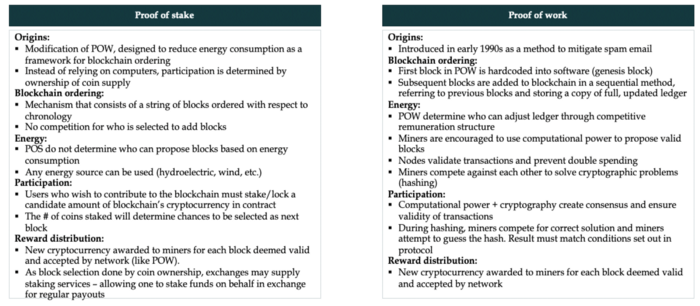

The table below outlines the key differences between the POS and POW consensus protocol methodologies.

When considering the cost of NFT production over the proceeding year, one notices that it is a function of several parameters, namely:

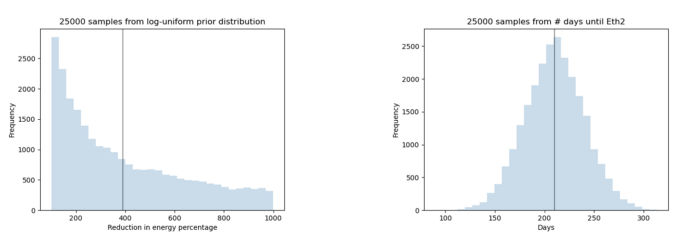

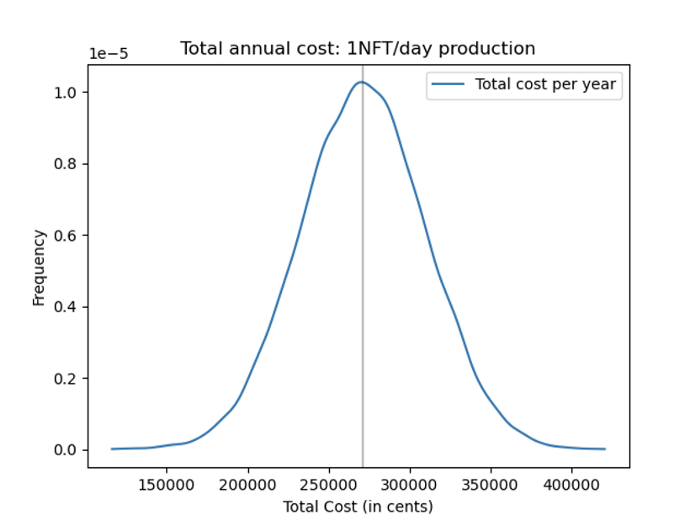

To explore the most probable cost of NFT production over the proceeding year, we design a simulation framework to study the distribution of NFT cost paths. To account for the uncertainty in aforementioned variables 1–4, we treat key parameters as random variables and run 25,000 simulations to explore the distribution of possible scenarios. Given the uncertainty in our parameters, we make the following assumptions regarding model parameters:

One can see the most probable parameter values for (1) # days until Ethereum 2.0 activation and (2) the magnitude of the reduction in electricity production after the transition below:

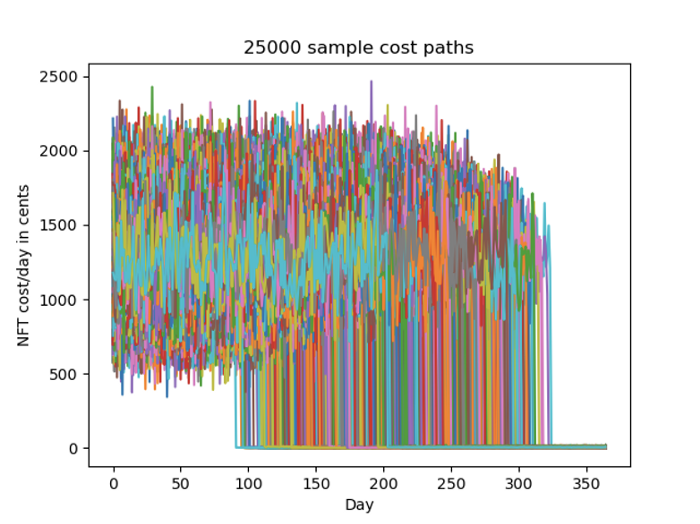

The simulation procedure integrates over a range of possible scenarios, taking account of their interactions, and producing paths of NFT costs. The sharp reduction in costs (with varying magnitudes) most prominently reflects the timing and impact of the switch to Ethereum 2.0.

Our simulation procedure suggests that, for one concerned with the electricity cost of producing 1 NFT per day for the proceeding year, it will likely cost ~ $2,715. One should note that this result is highly dependent on the underlying model assumptions, and should one have strong prior beliefs regarding parameter values, the simulation can easily be adjusted to account for this.

VivoPower International is pleased to announce that the company has signed a definitive agreement with GHH Group GmbH (GHH) for GHH to distribute electric light vehicles (e-LVs) in over 50 countries across Africa, Asia, Europe, and the Americas, using e-LV conversion kits from VivoPower’s wholly-owned subsidiary, Tembo e-LV B.V.

Under the agreement, GHH intends to purchase Tembo e-LV conversion kits through to December 2026. GHH will be responsible for acquiring original vehicles from Toyota, converting the vehicles to ruggedised e-LVs, using the Tembo solutions conversion kits, selling the units to end-customers, and providing ongoing servicing and maintenance.

This distribution agreement marks VivoPower’s fifth major distribution deal in 2021 for Tembo e-LV conversion kits and its largest to date by e-LV kit volumes. With the execution of this contract, VivoPower can now offer Tembo electric light vehicles to customers on six continents as it continues to advance its aim to build a global Tembo distribution network before the end of this year. The company previously executed distribution agreements with GB Auto Group in Australia, Acces Industriel Mining Inc. in Canada, and Bodiz International in Mongolia, in addition to announcing a non-binding Heads of Terms with Arctic Trucks Limited for distribution of Tembo e-LVs in Norway, Sweden, Iceland, and Finland.

Based in Germany, GHH has over 50 years of experience in the production of robust and safe vehicles for mining and tunnelling in hard and soft rock. Drawing on exclusive technology partnerships with several major industry leaders throughout the world, GHH offers the latest in cutting-edge innovation and product development to the underground mining market. Through collaboration with both clients and international partners, GHH engineers comprehensive, tailor-made solutions with their constantly expanding suite of mechanised mining equipment and a full range of well-established support services. That expertise makes GHH a natural partner to distribute Tembo e-LVs for miners seeking bespoke, comprehensive sustainable energy solutions.

The Tembo kits transform diesel-powered Toyota Land Cruiser and Hilux vehicles into ruggedised e-LVs for use in mining and other hard-to-decarbonise sectors, including construction and defence. Alongside solar generation, battery storage, and on-site power distribution, Tembo e-LV products are a key component of VivoPower’s turnkey sustainable energy solutions which help corporations achieve their decarbonisation goals.

Kevin Chin, Executive Chairman and CEO of VivoPower, said: “We are delighted to have executed this multi-country agreement with GHH, who are a trusted provider of customised technology solutions to the global mining industry. This is in keeping with our stated objective of cementing distribution agreements globally with highly credentialed partners such as GHH. With distribution partners on six continents now, Tembo e-LVs will be available globally for mining customers aiming to electrify their light vehicle operations as part of their paths to net zero mining.”

Sara Thorley, Global Marketing & Production Manager for GHH, said: “Being a global provider of heavy-duty mining machinery, we were constantly being asked about the possibility of supplying our customers with electric light vehicles. Due to the demand, we started looking at potential partners in this sector and after a substantial amount of research, we decided upon the Tembo electrification kit. First and foremost, the Tembo solution electrified the Toyota Land Cruiser and Hilux, which are the number-one light vehicles used in the mining sector globally; but secondly, the technology used created a vehicle that was smooth, efficient, safe, and very cost-effective. We are very excited about what the future holds for us and Tembo.”

To read our full press release, and to keep up with all VivoPower’s releases, visit our Press Releases page.

DDLS, Australia’s largest provider of corporate IT and process training, is pleased to announce its expansion into New Zealand with the acquisition of Auldhouse, New Zealand’s largest provider of ICT and digital skills training. The deal will add three campuses in New Zealand to the seven already established across Australia and the Philippines.

Customers of both companies will benefit from the relationship, with an unprecedented range of authorised ICT Training options from the widest selection of global vendors including the likes of Microsoft, AWS, VMware, Cisco, and Google. In addition, customers will see increased digital product offerings, a larger range of course events, a deeper pool of highly experienced and credentialed trainers, and the infrastructure across DDLS and Auldhouse to support continued growth.

Auldhouse is New Zealand’s largest and most awarded ICT and digital skills training provider and is a highly regarded brand that has been operating for over 30 years. With three campuses in Auckland, Wellington, and Christchurch, there is no other IT training provider that can match their geographic reach, breadth, depth, and regularity of public scheduled courses.

The move also marked a significant step in DDLS’s objective of growing internationally into the greater Asia-Pacific region, adding breadth to its expansion strategy with presence in Australia, the Philippines, and now New Zealand.

DDLS CEO, Jon Lang, stated that DDLS and Auldhouse have had a long-standing relationship, collaborating on numerous partnership initiatives: “Over the years we’ve built a mutual trust, respect, and confidence in the business operations and, as such, we see the business continuing to run as normal, with existing management and shareholders, Melanie Hobcraft, Leigh Richardson, and Craig Jones, all agreeing to remain in their roles at Auldhouse.”

Press release originally published here:

https://www.ddls.com.au/news/ddls-acquires-auldhouse-to-create-trans-tasman-ict-training-powerhouse/

About DDLS

DDLS is Australia’s largest provider of corporate IT and process training, with the largest portfolio of strategic partners and courses in Australia. We partner with world-class companies to help organisations and individuals in the IT industry remain up-to-date with new processes, technology, and platforms to reduce risk and enable efficient business practices. We have convenient locations in almost every capital in Australia as well as the Philippines, flexible delivery modalities, industry-accredited trainers, and state-of-the-art course material and labs to produce the highest quality learning outcomes for our clients.

About EdventureCo

EdventureCo, wholly owned by AWN Holdings Limited (ASX:AWN), is a vocational and professional education and training (VPET) platform established in Australia, with an expanding presence in Southeast Asia. It comprises market-leading businesses in blue-collar and white-collar VPET fields such as construction and IT. We have trained over 75,000 students in the past six years, and more than 196,000 in the past 26, providing them with skills and qualifications to commence their careers, upskill, or reskill. EdventureCo’s businesses are Everthought Education, DDLS, the Australian Institute of ICT, and ENS International.

Arowana’s private credit investment arm has reached agreement with ICAM Duxton STC Holdings Pty Ltd (ICAM) regarding the early settlement of its secured infrastructure debt facility for the Lucky Bay Port in South Australia. This has enabled co-investors with Arowana to realise a return in excess of the target IRR of 15%.

Lucky Bay provides an alternative grain supply channel for grain growers and other commodity suppliers on the Eyre Peninsula in South Australia. It is run by ICAM Duxton Port Infrastructure Trust (IDPIT) with ICAM as the fund manager and T-Ports as the operator, specialising in innovative logistical solutions for the export of Australian commodities. T-Ports was established by IDPIT in 2018 to initiate construction and project management of the Lucky Bay Port Facility development, with ICAM securing private debt and equity capital. The Lucky Bay Port generates road freight savings for grain growers from the Eyre Peninsula of up to $15 per tonne and 4,600 tonnes of CO2 emission savings annually.

Kevin Chin, Founder and CEO of Arowana, commented: “We are pleased to have had the opportunity to provide financial support for the development and growth of a pioneering and innovative port infrastructure project in Lucky Bay, South Australia. During the process, we were very impressed with how the ICAM and T-Ports management teams relentlessly overcame challenges posed by unexpected weather conditions and the COVID-19 pandemic in particular. As a B Corp as well as being seasoned operators who understand business challenges, we were happy to be a responsible and reasonable lending partner during challenging episodes. We would like to congratulate them on the successful close of their recent equity raising and we will be willing them every success going forward.”

ICAM’s Managing Director, Freddy Bartlett said: “Our team has shared a close working and commercial relationship with the team at Arowana in bringing this greenfields port infrastructure project to operational completion. This combined group has collaborated to work through the hurdles of a new start up infrastructure entity and the recent global challenges posed by COVID. We are extremely appreciative of the continued support from Arowana in helping to bring this South Australian port towards its ultimate growth potential.”

Johann Kenny, a Director at Arowana noted: “This transaction showcases the mutual success that can be achieved through close collaboration, open communication, and a deep understanding of the transaction’s operating and financial conditions and constraints which serve as a crucible for innovation in response to the inevitable challenges that no investment is immune to. It has been a pleasure to work with the ICAM and T Ports management teams.”

About Arowana

Arowana is a global B Corp certified group that has several operating companies and investments, including in electric vehicles, renewable energy, vocational and professional education, technology and software, venture capital, and impact asset management. Arowana’s purpose is to grow people, companies, and value.

About ICAM

ICAM is an alternative investments fund manager specialising in off-market sourcing, structuring, and active management of real estate and infrastructure assets.

ICAM has an institutional grade investment team bringing a sound investment philosophy, strong commercially focused risk-adjusted investment process, proven strategy, and an attractive track record. ICAM specialises in the investment and management of real assets in sectors such as commercial office, strategic retail, mixed use development, seniors living, and port infrastructure investments.

EBITDA Growth achieved in challenging environment

VivoPower executed strategic pivot to enter commercial Electric Vehicle market

EdventureCo delivered strong results on the back of successful digital transformation

Arowana Funds Management progressed realisation of investments

Highlights of AWN's FY2021 Annual Results and subsequent events:

Subsequent Events:

AWN's Annual Results Presentation can be viewed here.

VivoPower is pleased to advise that the company has rebranded its US solar development unit, formerly known as Innovative Solar Ventures, I LLC, renaming the business Caret LLC, coupled with a new Power-to-X strategy for the business unit, in order to maximise value with a view to a future potential exit (as has been previously announced).

Caret comprises 12 development-stage solar projects totalling 682 MW-DC, of which 11 are in Texas and one is in New Mexico. The projects are geographically diversified and strategically located in areas with relatively low solar project penetration. Each of the Caret projects has reached mid- to late-stage development status, with major interconnection and environmental studies completed and land secured for up to 40 years.

Since taking over full economic and management control of the Caret projects, the VivoPower team has been able to enhance the economics of the portfolio through value-added development activities including reduction of lease rates for several key projects. In addition, the company is currently undertaking a re-evaluation of previously abandoned projects, given the increasing potential demand from Power-to-X applications and partners.

Kevin Chin, Executive Chairman and CEO of VivoPower, said: “Power-to-X represents the use of excess renewable energy over and above baseload power for other energy-intensive applications. These include mining of cryptocurrencies, where we are seeing an increasing appetite from cryptomining groups to vertically integrate their operations to include renewable generation plants. Another area where we expect to see strong demand is from the green hydrogen sector. This will especially be the case if the $1.2 trillion US Infrastructure Bill is passed given the attractive incentives in the Bill for green hydrogen developers and producers. We believe the Power-to-X potential of Caret’s projects present a strategic pathway to maximising value, even though solar development in isolation is no longer our core activity. Our intention is to re-invest proceeds generated from any potential monetisation of Caret’s projects (with Power-to-X applications) back into our core sustainable energy solutions (SES) strategy.”

Once constructed and energised, the company believes Caret’s projects have the combined potential to generate more than 1.3 TWh of zero carbon electricity annually, enough to avoid over one million tonnes of carbon emissions each year (excluding previously abandoned projects).

To read our full press release, and to keep up with all VivoPower’s releases, visit our Press Releases page.

Completed strategic transformation to sustainable energy solutions (SES)

Acquired Tembo e-LV; distribution partner potential commitments for nearly 5,000 electric vehicle conversion kits

Raised $32 million in net proceeds from equity offerings; balance sheet fortified

Annual revenues of $40.4 million, impacted by COVID lockdowns

Underlying EBITDA decline to ($1.4) million loss from $3.9 million profit in FY20

VivoPower today announced its preliminary results for the fiscal year ended June 30, 2021.

Highlights for the fiscal year ended June 30, 2021:

VivoPower’s Full Year Results Presentation can be found here. A recording of the results teleconference will be available on our Investor Relations page under ‘Events and Presentations.’

VivoPower is pleased to announce that the Company has signed a definitive agreement with Bodiz International Group for Bodiz to distribute electric light vehicles (e-LVs) in Mongolia using e-LV conversion kits from VivoPower’s wholly-owned subsidiary Tembo. Under the agreement, Bodiz intends to purchase 350 Tembo e-LV conversion kits through December 2026. The company estimates these orders to be worth up to US$29 million in potential revenue over the life of the Distribution Agreement. Bodiz will be responsible for acquiring original vehicles from Toyota, converting the vehicles to ruggedised e-LVs using the Tembo solutions, selling the units to end-customers, and providing ongoing servicing and maintenance. The Tembo kits transform diesel-powered Toyota Land Cruiser and Hilux vehicles into ruggedised e-LVs for use in mining and other hard-to-decarbonise sectors, including construction and defence. Alongside solar generation, battery storage, and on-site power distribution, Tembo e-LV products are a key component of VivoPower’s turnkey net zero solutions for corporate decarbonisation.

This Distribution Agreement marks VivoPower’s fourth major distribution deal in 2021 for Tembo e-LVs across four continents and continues to advance the company’s aim to build a global Tembo distribution network before the end of this year. The company previously completed distribution deals with GB Auto Group in Australia and Acces Industriel Mining Inc. in Canada and has also announced a non-binding Heads of Terms with Arctic Trucks Limited for distribution of Tembo e-LVs in Norway, Sweden, Iceland, and Finland. The latter deal is expected to be finalized in the coming weeks.

Based in Ulaanbaatar, Bodiz has been distributing ruggedised SUVs and other heavy-duty vehicles to the Mongolian market since its founding in 1997. In addition to Tembo vehicle distribution, the Distribution Agreement includes plans for Bodiz to send technicians to Tembo’s Netherlands headquarters to be trained in e-LV conversion, as well as a potential expansion of Bodiz’s facilities to service Tembo electric vehicles.

Kevin Chin, Executive Chairman and CEO of VivoPower, said: “We are pleased to continue expanding our global distribution network for Tembo e-LVs through this partnership with Bodiz. With the signing of this Distribution Agreement, Tembo e-LVs will be available to mining and other heavy industrial customers aiming to decarbonise their fleet operations through distribution partners on four continents. We look forward to building this relationship and working with Bodiz to support more customers on the drive to net zero.”

Dulguun Baatarsukh, CEO of Bodiz, said: “Bodiz is very glad to become a member of the Tembo e-LV family. Mongolia's economy, especially the mining sector, is growing rapidly with one of the world’s richest mineral resources. It is an honour to sign this Distribution Agreement with VivoPower for Bodiz to introduce Tembo e-LVs to our domestic market and take part in the global change of electrification. I hope we will continue to strengthen this partnership and cooperation in the long run and make a significant contribution to the mining sector in our region.”

VivoPower is pleased to announce that the Company has secured a settlement resulting in it gaining full ownership of the remaining 50% of the equity interest in its solar development portfolio in the US. Ownership of the portfolio was previously shared 50/50 with VivoPower’s former joint venture partner, Innovative Solar Systems LLC (“ISS”).

Ownership of the remaining 50% interest in the portfolio was acquired by VivoPower from ISS for nominal consideration under the terms of the settlement between VivoPower and ISS.

Investors have set their sights on the world’s innovation capitals.

Silicon Valley continues to set the gold standard for technology hubs around the world, consistently ranking #1 across different subsectors such as artificial intelligence, robotics, and life sciences. The region has an ecosystem value of US$677bn, according to research firm Startup Genome.

Global venture capital, however, is fuelling the growth of startups and scaleups outside of California. Even the more established names in tech, like Google and Facebook, have been investing heavily in building their own research and development centres beyond Silicon Valley.

Which world cities are transforming into innovation capitals?

Tel Aviv

Out of all the global tech hubs on this list, Tel Aviv might just be the fastest riser. This city on the Mediterranean coast leads the world in the number of startups per capita. It is currently home to more than 100 foreign R&D and innovation centres including Amazon, Barclays, Facebook, and Google.

Tel Aviv has positioned itself as a major hub for AI development. The sector makes up more than 40% of all startups in the city. AI companies also employ a quarter of the entire workforce in Tel Aviv. Other sectors thriving in the Nonstop City include the medical, automotive, aerospace, and cybersecurity industries.

Israel exports as much as US$6.5bn worth of cybersecurity products every year. It was also the first in the world to offer a cybersecurity PhD programme. There are now six cybersecurity university research centres operating in the country.

The Israeli government is also very supportive of local businesses. This is one of the many reasons the country is such an attractive place to invest in for startups.

Israel offers backed loans for businesses that need funding and encourages institutional investors to enter the market. The Ideation (Tnufa) Incentive Program, for example, was created to help fledgling entrepreneurs develop innovative concepts. It offers grants of up to 85% for approved expenses.

The Tnufa fund is available for both local and foreign investors. Entrepreneurs with no ties to Israel can apply for funding by first securing a visa. Once they do, they are eligible to get financial support on the condition their operations remain based in Israel. The Tnufa fund allows recipients to develop their business ideas without taking on debt.

The Israeli government also launched a US$462m+ support plan as part of its COVID-19 policy. The program includes a US$200m+ aid package to small and midsize companies through the Israel Innovation Authority.

Israel remains a very stable ecosystem. In 2020 alone, Israeli companies and startups raised nearly US$9.5bn in capital.

New York

The Big Apple has made significant strides in the tech space over the past few years. The subsectors powering this are AI, big data analytics, cybersecurity, and education technology. Overall, there are more than 100 startup incubators and 9,000 startups in New York. In 2020, 886 companies in this tech haven attracted VC funding of about US$16.2bn.

Shanghai

Shanghai is committed to helping businesses innovate. Zhangjiang Hi-Tech Park, often referred to as China’s Silicon Valley, can be found in the city. It has over 400 R&D centres and has attracted more than 1,000 startups, mostly from the education technology and gaming sectors.

China is also the world’s largest market for mobile gaming. More than 25% of global gaming revenue comes from the country. Shanghai, for its part, is home to over 130 gaming startups.

Deal-making in the city is also thriving. In fact, EdTech firms have received about US$1.3bn in venture funding between 2015 and 2017.

London

London, where Alicorn is headquartered, isn’t just Europe’s global financial centre anymore―it’s also fast becoming a major tech hub. Many consider the city as the third most important innovation centre in the world today.

According to a report by Business & Industry, UK tech investments reached £10bn for the first time in 2019. The local tech industry itself grew six times faster than any other industry.

The London tech hub owes much of its growth to a startup visa program. To attract potential investors, the city introduced in 2019 a two-year visa route that allows early-stage but high–potential entrepreneurs to enter the country and start a business.

If you’re about to launch your startup, you’ll have three things going for you in London: easy access to investors, consultants, and experts; opportunities at networking; and a great talent pool.

Meanwhile, if you are already an established entrepreneur, you can benefit from the guidance of 125 incubators in the city who can help you grow your business even further.

Tokyo

Tokyo is emerging as another hotbed for tech startups. For decades, Japan has served as the world’s most active industrial robot manufacturer, producing more than half of the global robotic supply. It didn’t take long for other tech sectors to grow.

Today, Japan is one of the best places for fintech companies and other tech startups to make their mark. The country ranks as the third most competitive financial centre in the world, according to the Global Financial Centres Index.

Moreover, in 2017, the Tokyo Metropolitan Government established the Tokyo Financial Award. The honour is given to financial institutions that provide innovative products and services that meet the needs of Tokyo citizens. It also helps promote ESG investments in the city.

The Japanese government also announced its “Beyond Limits, Unlock Our Potential” strategy. The initiative is meant to strengthen the country’s startup ecosystem. The plan includes providing entrepreneurship education, improving accelerator programs, and creating a startup hub in the city. In 2018, former Prime Minister Shinzo Abe also laid out the country’s plan to develop at least 20 tech unicorns by 2023.

Singapore

Singapore’s land area might not be as big as Tokyo or Shanghai’s, but it’s a financial and tech powerhouse in Asia, nonetheless. What the city-state lacks in geographical size, it more than makes up for in grit. Singaporeans are some of the hardest-working people in the tech industry.

The Southeast Asian hub also benefits from innovative business strategies and a highly skilled talent pool. The government’s primary goal is to create a culture of innovation by attracting talent with the right mindset.

Businesses enjoy several other advantages, such as low taxes and strong investment opportunities. They also benefit from the city’s IT infrastructure, which is deemed one of the best in the world.

As proof of Singapore’s resilience, the city-state attracted US$17.2bn in fixed asset investments in 2020, at a time when many other ecosystems faltered due to the COVID-19 pandemic.

The government also doubled down on its commitment to grow businesses by investing US$19bn into enterprises as part of its 2020 Research Innovation and Enterprise plan.

Toronto

Toronto is a haven for high-calibre tech professionals, and this talent pool has helped the city attract entrepreneurs looking to start their business. In 2017, Toronto produced the highest number of tech jobs in the world. It managed to beat other markets like the San Francisco Bay Area, Seattle, and Washington, D.C. In the same year, the city also edged out New York in a “talent markets” ranking.

Toronto is also home to academic institutions on the cutting-edge of development, such as the University of Waterloo and University of Toronto. Both schools are known for producing promising engineers and developers.

The city government also supports local investment and employment through its Economic Development and Culture Division.