The Australian federal government has recently announced plans to invest nearly $1.2bn for its Digital Economy Strategy, which aims to prepare the country for the challenges and opportunities that come with rapid digital transformation. Additionally, the strategy aims to deliver a modern digital economy by 2030.

“Every business in Australia is now a digital business,” says Prime Minister Scott Morrison. “This transformation is not merely a national one that needs to happen—it’s a global one that is happening. We must keep our foot on the digital accelerator to secure our economic recovery from COVID-19.”

Spotlight on digital skills

The Digital Economy Strategy will prioritise investing in emerging technologies, building digital skills, encouraging business investment, and enhancing digital government service delivery. In particular, the initiative earmarks a $101.8m investment towards improving digital skills, including a pilot program for work-based digital cadetships.

Recent estimates reveal that 87% of jobs now require digital skills across every sector and industry. Additionally, it is estimated that 250,000 new jobs will be created as a result of digitalisation by 2025. In 2019 alone, Australia had more than 770,000 technology workers—and this number continues to grow.

As such, this investment towards digital upskilling will help create a pipeline of graduates with advanced digital skills, all coming through Australia’s education and training ecosystem, of which EdventureCo is a part.

This is a step in the right direction. Our goal has always been to equip students with relevant digital skills in a fast-changing world. Today, work is changing faster than education. This significant investment towards digital skills helps strengthen the capabilities for our future workforce.”

Areas for improvement

While these investments are a welcome boost for the technology sector, there are still some areas that need a stronger commitment from the federal government.

Ron Gauci, CEO of the Australian Information Industry Association, says that while the $124.1m investment in artificial intelligence, for example, exhibits the federal government’s commitment to the Digital Economy Strategy, this may not be enough to fully develop the sector. In April, the Association demonstrated that $250m was needed to fully fund a national AI strategy. However, only half of that was allocated by the federal government.

Additionally, some technology leaders found that the federal government’s $50m investment towards enhancing cybersecurity was lacking. Ian Yip, CEO of cybersecurity firm Avertro, says that this speaks to how underinvested the national ecosystem is on the issue of cybersafety.

At EdventureCo, we drive upskilling for the digital economy. In step with the Australian federal government’s vision for a digital economy, EdventureCo will continue to equip students with relevant digital skills that will give them an edge in an increasingly automated world.

Tottenham Hotspur has today announced that its Official Battery Technology Partner, VivoPower has completed feasibility studies to assess initial opportunities for sustainable energy solutions (SES) at both Tottenham Hotspur Stadium and the Club’s Hotspur Way Training Centre in Enfield. The Club and VivoPower are now exploring the potential of moving forward with the implementation of one or more SES projects.

Following on from the announcement of the unique partnership in February, VivoPower completed an engineering review of both facilities to pinpoint optimal solutions and an array of potential projects to reduce both carbon footprint and energy costs. The Club is now working with VivoPower to assess the engineering and design of renewable energy infrastructure that could be installed at both the stadium and training centre.

This important milestone highlights Tottenham Hotspur’s ongoing efforts towards decarbonisation and minimisation of the environmental impacts of its activities across all Club operations. The Club has recently been recognised as the English Premier League’s greenest club following a study carried out by BBC Sport and the UN-backed Sport Positive Summit.

The Club is also a signatory of the UN Sports for Climate Action Framework, demonstrating its commitment to playing its part to ensure the sports sector is on the path to a low-carbon future, in line with the aims of the Paris Agreement. Additionally, last year Tottenham Hotspur became a founding partner of Count Us In, a global movement aiming to mobilise 1 billion people in the fight against climate change.

Donna-Maria Cullen, Executive Director of Tottenham Hotspur, said: “The Club is committed to achieving its sustainable goals and is encouraged by the findings of the feasibility studies carried out by VivoPower.

“Both our stadium and training centre have been built with sustainability in mind and we look forward to working closely with Vivo to assess the implementation of further measures.”

Kevin Chin, Executive Chairman and CEO of VivoPower, noted: “We are very pleased that the outcome of the feasibility studies confirm significant opportunities to deliver reductions in emissions as well as costs for Tottenham Hotspur. Our team will now be working closely with the Club to look at how we could implement holistic sustainable energy solutions.”

Joshua Krasnigor, Senior Engineer and Project Technical Director of VivoPower, said: “We are excited to progress the SES opportunities identified over the past few months for Tottenham Hotspur’s state-of-the-art facilities. The solutions we are developing through this partnership will represent a major step towards achieving Tottenham Hotspur’s sustainable goals while simultaneously reducing the Club’s operating costs.

“VivoPower looks forward to continuing to work with Tottenham Hotspur to discuss implementing these SES projects and continue developing bespoke solutions for the Club as they lead the way for sports organisations pursuing decarbonisation.”

VivoPower is pleased to announce that the company has entered a binding Letter of Intent with Toyota Motor Corporation Australia Limited to create a collaboration programme between VivoPower and Toyota Australia for the electrification of Toyota Land Cruiser vehicles using conversion kits designed and manufactured by VivoPower’s wholly-owned electric vehicle subsidiary, Tembo e-LV B.V.

The binding LOI sets out the terms for the purchase of preliminary goods and services and the basis upon which a Master Services Agreement (MSA) is expected to be finalised to govern an electric vehicle conversion partnership between VivoPower and Toyota Australia. Final terms of the MSA are under negotiation, but upon completion, it is intended that VivoPower would become Toyota Australia’s exclusive partner for Land Cruiser 70 electrification for a period of five years, with a further two-year option (seven years in total).

Kevin Chin, Executive Chairman and CEO of VivoPower, said: “We are extremely pleased to be collaborating with Toyota Motor Corporation Australia, part of the world’s largest original equipment manufacturer on the electrification of their Land Cruiser vehicles with our Tembo conversion kits. The Land Cruiser is the vehicle of choice worldwide for mining and other ruggedised industries. This partnership with Toyota Australia is a testament to the outstanding potential of Tembo’s technology to decarbonise transportation in some of the world’s toughest and hardest to decarbonise industries. More importantly, it is a tremendous opportunity for us to work directly with Toyota Australia to optimise the Tembo product and deliver it to more customers around the world, helping them to achieve their net zero carbon objectives in the process.”

While the MSA is still to be finalised, the LOI is a binding agreement between VivoPower and Toyota Australia to begin collaboration on Land Cruiser electrification efforts.

VivoPower and Toyota Australia intend to finalise the MSA as soon as practicable.

Leading Canadian industrial equipment distributor Acces Industriel Mining Inc. intends to purchase 1,675 electric vehicle conversion kits over five-plus years, marking VivoPower’s second major distribution agreement for Tembo e-LV products.

VivoPower has signed a definitive agreement with Canadian industrial equipment distributor Acces Industriel Mining Inc. for Acces to distribute electric light vehicles in Canada, using e-LV conversion kits from VivoPower’s wholly-owned subsidiary, Tembo e-LV B.V.

Under the agreement, Acces intends to purchase 1,675 Tembo e-LV conversion kits between now and December 2026. The company estimates these orders to be worth US$120m in total value over the next five-and-a-half years, with a delivery schedule weighted towards the latter part of the Distribution Agreement period. Acces will be responsible for acquiring original vehicles from Toyota, converting the vehicles to ruggedised e-LVs using the Tembo solutions, selling the units to end-customers and providing ongoing servicing and maintenance.

The Tembo kits transform diesel-powered Toyota Land Cruiser and Hilux vehicles into ruggedised e-LVs for use in mining and other hard-to-decarbonise sectors, including construction and defence. Alongside solar generation, battery storage, and on-site power distribution, Tembo e-LV products are a key component of VivoPower’s turnkey net zero solutions for corporate decarbonisation.

The Distribution Agreement follows January’s distribution agreement with GB Auto Group Pty Limited and GB Electric Vehicles Pty Ltd. The company has announced plans to complete a global Tembo distribution network by the end of this year, and discussions with other distributors are active and ongoing across Europe, Africa, the Middle East, the Americas, and Asia.

VivoPower selected Acces as the company’s distribution partner in Canada because of Acces’s established, long-term experience supplying, customising, and servicing Toyota Land Cruisers, as well as its extensive active relationships with dozens of mining companies which make Acces a leading provider of ruggedised vehicle solutions to Canada’s mining industry.

Kevin Chin, Executive Chairman and CEO of VivoPower, said: “We are very pleased to have finalised this Distribution Agreement with Acces, which will provide the springboard for VivoPower to deliver our Tembo e-LVs and complementary sustainable energy solutions to Canadian customers. As a leading and trusted provider of equipment and services to the Canadian mining industry, Acces’s selection of Tembo as their preferred electric vehicle solution is a testament to the quality of the Tembo product and the value it offers to mining and other industrial customers seeking net zero carbon solutions. Both VivoPower and Acces continue to see significant demand for corporate decarbonisation solutions, and we look forward to working together to help Canadian organisations achieve their net zero ambitions.”

Jean Dion, CEO of Acces, commented: “Acces is excited to complete this Distribution Agreement with VivoPower and to begin the work of delivering fully-electrified Tembo vehicles to our customers across the mining, forestry, industrial, and construction markets. We are confident that the Tembo product offers outstanding value to our customers who seek to reduce their carbon emissions, and Acces will not distribute any competing product over the life of the Distribution Agreement. As demand for net zero solutions continue to increase, we look forward to working with VivoPower and Tembo to provide the electric vehicle solutions our customers demand.”

Alicorn Global Ventures (Alicorn), which invests in late-stage technology companies, announces that its strategic investment, Glassbox Ltd (Glassbox), today started trading on the Tel Aviv Stock Exchange (TASE: GLBX). Alicorn is the global venture capital arm of Arowana International, the established B Corporation-accredited investment group.

Glassbox is a UK-headquartered global technology company that has developed an analytics platform that provides a complete view of all customer interactions across internet and mobile channels. The technology encompasses Traditional Web Analytics and Application Performance Management (APM), providing real-time analysis to identify issues and improve digital customer experience.

Today’s listing values Glassbox at pre-money valuation of US$350m, delivering another successful exit for Alicorn, which has invested $9m in the company since May 2020. Alicorn’s investment approach is to identify secondary and unique primary opportunities in top-tier, fast-growing technology companies. Alicorn leverages proprietary access to unlock value in harder-to-access, under-the-radar companies.

Alexander Assim, Principal at Alicorn says: “Glassbox is an attractive investment with proven, proprietary technology and a strong leadership team. Today’s successful listing reflects the company’s prospects and Tel Aviv’s increasing influence as a hub for technology investments.”

“At Alicorn, we focus on hard-to-access, tech-enabled companies at late-growth stages, which offer significant potential for investment performance.”

VivoPower and its wholly-owned subsidiary, Tembo e-LV B.V., have entered a non-binding Heads of Terms with leading ruggedised vehicle converter Arctic Trucks for Arctic Trucks to convert and distribute Tembo electric light vehicles in Norway, Sweden, Iceland, and Finland.

Under the proposed agreement, Arctic Trucks would commit to purchase 800 Tembo e-LV conversion kits through December 2026. Based upon the company’s estimates, these orders could be worth an estimated US$58m in total value over the life of the proposed agreement. The proposed agreement must be finalised prior to June 30, 2021, unless the parties agree to an extension, and all purchase commitments would be subject to the terms and conditions set forth in the final agreement.

The Tembo kits transform diesel-powered Toyota Land Cruiser and Hilux vehicles into ruggedised e-LVs for use in mining and other hard-to-decarbonise sectors, including construction and defence. Alongside solar generation, battery storage, and on-site power distribution, Tembo e-LV products are a key component of VivoPower’s turnkey net zero solutions for corporate decarbonisation.

This proposed agreement would mark VivoPower’s third major distribution deal in 2021 for Tembo e-LVs across three continents and would continue to advance the company’s aim to build a global Tembo distribution network before the end of this year. The company previously completed a distribution deal with GB Auto Group in Australia in January, and announced a non-binding Heads of Terms with Acces Industriel Mining Inc. for distribution of Tembo e-LVs in Canada last week. The latter deal is expected to be formalised before the end of June.

Arctic Trucks specialises in the re-engineering and conversion of four-wheel drive vehicles for extreme conditions, particularly in the harsh polar regions. Arctic Trucks vehicles have enabled ventures to the North Pole and erupting Icelandic volcano Eyjafjallajökull on television’s Top Gear and set the Guinness World Record for the fastest overland journey to the South Pole. Those credentials made Arctic Trucks a natural choice for a partnership to convert and distribute Tembo e-LVs designed for mining and other ruggedised applications.

Kevin Chin, Executive Chairman and CEO of VivoPower, said: “We are extremely pleased to be partnering with Arctic Trucks to expand the distribution reach of our Tembo vehicles. Tembo e-LVs are engineered and built to enable decarbonisation through fleet electrification in some of the world’s harshest and most carbon-heavy industries. Arctic Trucks are no strangers to the challenges of engineering vehicles for ruggedised environments, and we look forward to working with them to help mining and other customers in the Nordic regions achieve net zero carbon goals previously thought impossible.”

Under the proposed agreement, it is intended that Arctic Trucks would commit to purchase the 800 kits from VivoPower as scheduled over the duration of the agreement, acquire an equal number of Land Cruisers or Hiluxes from Toyota, convert the vehicles to ruggedised e-LVs using the Tembo solutions, sell the units on, and be retained by customers for servicing and maintenance.

VivoPower and Arctic Trucks intend to finalise the proposed agreement as soon as practicable.

Alicorn, the global venture capital arm of Arowana, has just closed its investment in Pliops, an Israeli hardware storage acceleration company. It comes at a key growth inflection point for Pliops and represents the sixth company that Alicorn has invested in as part of its global venture capital secondaries strategy.

Alicorn has invested a total of US$4m to acquire secondary shares in Pliops, a technology leader that enables cloud and enterprise customers to offload and accelerate data-intensive workloads using a fraction of the computational load and power at significantly lower cost. Its solution is helping companies and data centres deal with an explosion in data workloads as CPUs struggle to keep up. Their patent-backed hardware offers breakthrough economics and performance for a wide range of data centre applications.

Pliops’ client base includes some of the world’s largest cloud, web, and edge service providers in addition to Fortune 1,000 IT companies. The company is backed by leading companies in the compute and storage space including Western Digital, Xilinx (AMD), Mellanox (NVIDIA), Intel, and most recently, Koch Disruptive Technologies (KDT).

As a storage processor company, Pliops is solving a business-critical yet worsening problem: exponential growth in data workloads combined with an end to Moore’s law. This convergence of trends is creating a race to solve a massive compute problem that we are consistently losing.

The company’s hardware-based solution eliminates the inherent inefficiencies present in both databases, analytics, machine learning, and software-defined storage and is already proving itself as the solution to the problem. We are very excited to be working with Uri Beitler and the team at Pliops. We are confident in their ability to execute and grow, and look forward to the journey ahead.

Jos van der Linden has joined our team as Managing Director (Netherlands) for our electric light vehicle division, Tembo e-LV B.V.

Jos is a seasoned executive who has spent his career at the forefront of vehicle electrification and renewable energy. For more than a decade, he worked for Spijkstaal Elektro, an innovative international company that was the first in the market to convert internal combustion engine cars into fully electric and serial electric hybrid vehicles. He has also been a leader in the development of many customer-specific, electrically driven solutions in various markets, with experience in battery technology, solar, and wind energy applications.

In addition to his years of experience delivering sustainable energy solutions, Jos has held several management positions within both family businesses and publicly traded companies. He has a background in business economics, supplemented with studies in the fields of Sustainable Materials Management and Electric Vehicles and Mobility.

Jos possesses extensive direct experience in the development of electric vehicles, battery technology, and related electric power solutions. We are delighted to welcome him to VivoPower and look forward to his leadership as we hyperscale the Tembo business.

VivoPower also recently welcomed James Howell-Richardson as General Counsel. Based in London, James spent the last decade working as part of the senior leadership team for NYSE-listed Bristow Group Inc., the world’s leading global helicopter operator. In that role, he oversaw the legal function and several technical areas including joint ventures, mergers and acquisitions, corporate governance, public procurement, and commercial contract negotiations with blue-chip clients.

James has led and been an integral part of numerous complex corporate and organisational restructures and transformations. He has also held several international directorships across the globe. His depth of strategic, management, and legal knowledge gives him an all-around ability to help support and deliver the objectives of VivoPower. He will be a vital member of our leadership group.

In this paper, we study the behaviours and similarity profile of country financial indices, sector financial indices, and equities over the past 20 years.

First, we introduce a new methodology to determine the similarity of 20 countries and 11 sectors with respect to their time series’s structural breaks. We introduce a new metric that can quantify distance between any two candidate sets, where a probability distribution determines the uncertainty surrounding the locations of various elements. Next, we turn to US equities, where we administer three separate experiments. First, we analyse the evolution of equity crisis correlations over time, highlighting the increase in equity similarity in recent years, and in times of market panic. Next, we investigate the collective similarity of equity trajectories over time and demonstrate greater distance between trajectories during times of crisis. Finally, we explore the dynamics of our equity market collection, via a time-varying principal component analysis. We highlight current areas of difficulty in spreading investments among assets exhibiting homogenous behaviours, and suggest approaches that may improve investor diversification.

Motivation of this study

In March-June 2020, global markets exhibited extreme behaviours due to the COVID-19 crisis. Investors struggled amidst declining asset prices and volatility, as many "traditional" diversification strategies did not appear to be effective. In fact, intra-asset correlations seemed to be particularly high—even relative to previous market crises. This triggered our curiosity, and we thought it warranted a thorough investigation.

Despite the wealth of data available to financial market participants, there is a tendency for many investors to focus on the recent past. This is sensible. Market dynamics are continuously changing, and although history may rhyme, it certainly doesn’t repeat itself and financial market behaviours in 2020 are most unlikely to be identical to those in 2000 as many aspects of financial markets have altered substantially over the past two decades.

This paper is written with a different purpose. We wish to study how country, sector, and equity behaviours have evolved over the past 20 years—especially during times of crisis. We introduce new methodologies to examine changes in erratic behaviours, trajectories, and time-varying dynamics.

We break our analysis into two parts. First, we study the similarity in structural breaks among countries and sectors. This analysis could be useful for any asset allocator or investor looking to diversity their investments with respect to country or sector exposure. Second, we study S&P 500 equities, and explore the evolution of correlations, trajectories, and time-varying dynamics. Insights from this work could be used by any global equity investor interested in the dynamic phenomenology exhibited by equities over the past 20 years.

Data

Our country and sector data spans 4/1/2002–8/10/2020 and 4/1/2000–8/10/2020 respectively, and measured daily. The countries we analyse include Australia, Brazil, Canada, China, France, Germany, India, Indonesia, Italy, Japan, Korea, the Netherlands, Russia, Saudi Arabia, Spain, Switzerland, Turkey, the UK, and the U. The sectors we analyse include Communications, Consumer Discretionary, Consumer Staples, Energy, Financials, Healthcare, Industrials, Information Technology, Materials, Real Estate, and Utilities. Our equity data spans 3/1/2000–8/10/2020. We study all S&P 500 equities in existence from the date of inception until the end of our analysis window. This leaves us with 347 equities, and all our data is sourced from Bloomberg.

Erratic behaviour modelling

In this section, we study the similarity in the erratic behaviours of 20 country indices and 11 financial market sectors. To determine similarity, we apply a change point detection method to each time series and generate sets of change points. Importantly, we use a methodology that detects change points based on changes in the power spectrum. This alleviates issues that many change point detection methodologies face when confronted with dependent data. Prior work has demonstrated that the methodology applied in this paper appropriately detects change points in piecewise autoregressive processes, highlighting the algorithm’s ability to partition dependent data. For those interested in the methodologies applied, please see one of the following papers:

As dependence is often the case in financial time series, we use the aforementioned technique. This methodology is implemented in a Bayesian framework, and captures uncertainty around candidate change points. We adjust a previously introduced semi-metric to account for uncertainty surrounding candidate change points when measuring distance between sets.

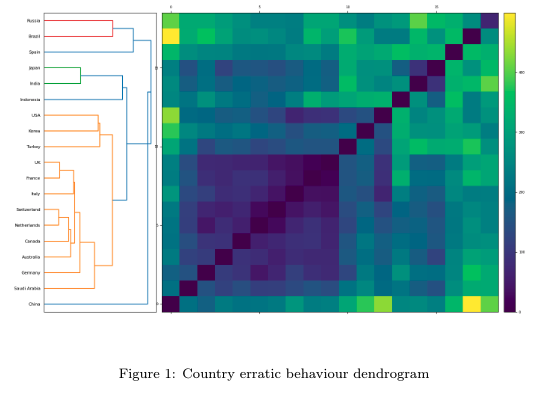

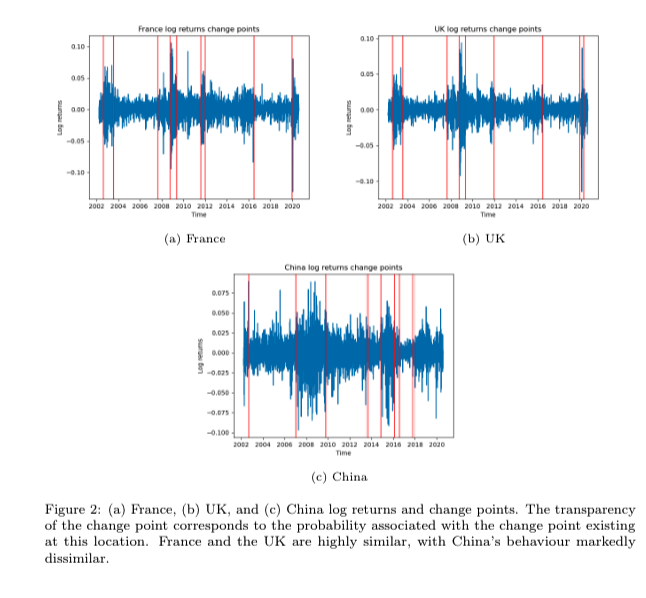

The erratic behaviour cluster structure of the country financial indices suggests that there is one predominant cluster of countries and several other diffuse clusters. The primary cluster consists of Korea, Turkey, France, Italy, Switzerland, Netherlands, Canada, Australia, Germany, Saudi Arabia, the UK, and the US. The collection of outlier countries includes Russia, Brazil, Spain, and China. These cluster memberships and associated change points may be due to substantial similarity in the geographic location and political association of such countries, leading to similar market behaviours during events such as Brexit. Notably, Spain is determined to be markedly less similar than its European counterparts. The most anomalous country within the collection is China. This is unsurprising, as many of the idiosyncratic restrictions related to their local equity market may provide different dynamics to those exhibited by other financial markets.

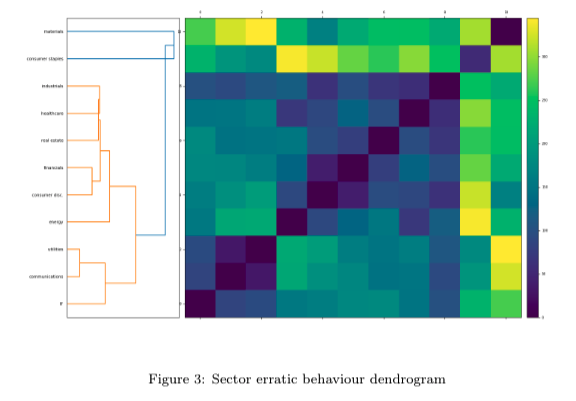

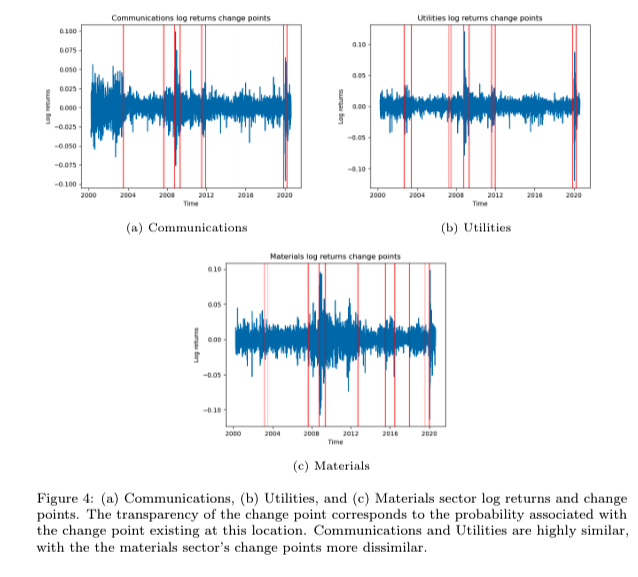

The sector erratic behaviour dendrogram consists of 2 clearly separated clusters. The primary cluster consists of all stocks The sector erratic behaviour dendrogram consists of two clearly separated clusters. The primary cluster consists of all stocks except materials and consumer staples. Interestingly, the utilities, communications, and IT sectors exhibit no structural breaks in the period between 2012–2019. By contrast, several change points are detected in the materials sector time series during this time window. Change points are also detected between 2012–2019 in the sector time series within the predominant cluster (financials, consumer discretionary, etc.). Figure 4 displays the log returns and detected change points for the communications, utilities, and materials sectors. One can see the stark difference in the propagation of structural breaks in the period between 2012–2019.

To compare the degree of similarity between countries and sectors, we compute the matrix norms of our erratic behaviour matrices, and normalise them by the number of elements in the matrix (as there is a different numbers of countries/sectors in our previous experiments). The country erratic distance matrix norm is higher than the sector erratic distancTo compare the degree of similarity between countries and sectors, we compute the matrix norms of our erratic behaviour matrices, and normalise them by the number of elements in the matrix (as there is a different number of countries/sectors in our previous experiments). The country erratic distance matrix norm is higher than the sector erratic distance matrix norm. The smaller value in the sector norm suggests that the erratic behaviour profile is much more similar among sectors than it is among countries. This could suggest that diversification benefits are more substantial to investors diversifying with respect to countries (as opposed to sectors).

In this section, we study 347 US equities over ~ 20 years. We break our analysis into three separate sections. First, we examine the behaviour of correlation coefficients during various discrete (and distinct) time periods. Next, we study the In this section, we study 347 US equities over ~ 20 years. We break our analysis into three separate sections. First, we examine the behaviour of correlation coefficients during various discrete (and distinct) time periods. Next, we study the collective similarity in rolling equity trajectories. Finally, we explore the time-varying eigenspectrum—as a means of highlighting periods in time where the “market effect” is most pronounced (indicated by the size of the leading eigenvalue).

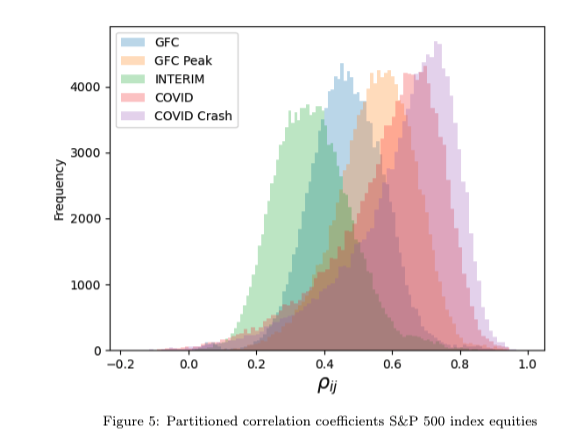

In this section, we partition our analysis window into five periods: GFC, Peak GFC, Interim (the period between the GFC and COVID), COVID, and Peak COVID. The date windows for each time partition are as follows:

Within each period, we compute the correlation matrix for all equities in our collection, and plot the distribution of correlation coefficients.

Figure 5 presents two findings. First, there is clearly an increase in the correlation of equities during times of crisis. This is reflected in both the GFC and COVID-19 market crashes, but this spike in correlation is even more pronounced at the peak of these crashes. That is, the Peak GFC and Peak COVID distributions are centred further to the right than the GFC and COVID distributions respectively. Second, this increase in correlations has become more pronounced in recent times. Figure 5 suggests that equity behaviour has become more similar during times of crisis. The implications of this finding are alarming, and suggest that traditional Markowitz-inspired portfolio diversification frameworks have to be altered, at least within the context of pure equity portfolios.Figure 5 presents two findings. First, there is clearly an increase in the correlation of equities during times of crisis. This is reflected in both the GFC and COVID-19 market crashes, but this spike in correlation is even more pronounced at the peak of these crashes. That is, the Peak GFC and Peak COVID distributions are centred further to the right than the GFC and COVID distributions respectively. Second, this increase in correlations has become more pronounced in recent times. Figure 5 suggests that equity behaviour has become more similar during times of crisis. The implications of this finding are alarming, and suggest that traditional Markowitz-inspired portfolio diversification frameworks must be altered, at least within the context of pure equity portfolios.

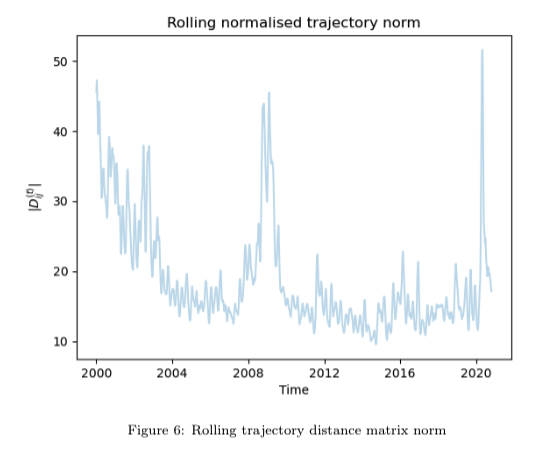

In this section we study the rolling similarity in equity trajectories. To do so, we normalise all trajectories by their L_1 norm, and compute distances between all candidate trajectories on a 45 day rolling basis. Figure 6 demonstrates that periIn this section, we study the rolling similarity in equity trajectories. To do so, we normalise all trajectories by their L1 norm, and compute distances between all candidate trajectories on a 45-day rolling basis. Figure 6 demonstrates that periods of crisis provide the most heterogeneity in trajectories. In particular, the dot-com bubble, GFC, and COVID-19 market crisis all display spikes in the rolling norm computation.

Although there is an increase in trajectory distance matrix norms during periods of crisis, the direction of trajectories is still largely uniform. During crises, the overwhelming direction of equities is downward. The uniformity is confirmed in our correlation analysis, where correlation coefficients are more strongly positive. This is interesting.

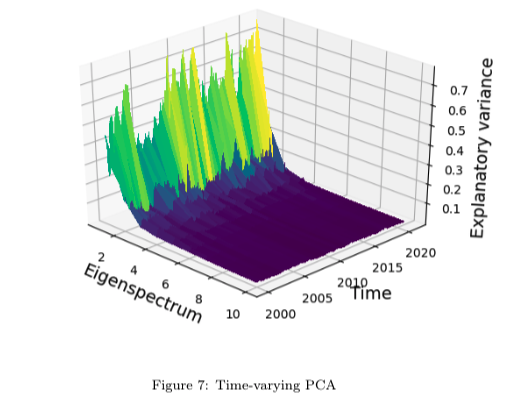

Finally, we implement a time-varying principal components analysis, where we plot the percentage of explanatory vaFinally, we implement a time-varying principal components analysis, where we plot the percentage of explanatory variance exhibited by each eigenvector. Given that the first eigenvector represents the collective strength of the market, when there is a spike in the first element of the eigenspectrum, it is indicative of an increase in the strength of collective market behaviours.

Figure 7 shows spikes in the first element of the eigenspectrum during the dot-com bubble, GFC and the COVID-19 market crisis. This confirms our earlier findings in the study of correlations, indicating that market dynamics are markedly more homogenous during times of crisis.

Our erratic behaviour modelling highlights sectors and countries that behave most similarly and dissimilarly. Of the 20 countries analysed, there is one predominant cluster that consists primarily of European countries. The sector erratic behaviour analysis finds one primary cluster among the 11 sectors analysed. Materials and consumer staples are found to be most dissimilar to other sectors in terms of their erratic behaviours. Our (normalised) matrix norm analysis suggests that it may be more difficult to diversify across sectors than countries. This is highlighted by the larger value for the country erratic distance matrix norm. Our correlation analysis provides two insights. First, equity correlation has increased over time. Second, equity correlation spikes during market crises. Our trajectory analysis and rolling PCA indicates that although trajectories show the most heterogeneity during crises, collective market dynamics are strongest during these periods. Such findings could be of interest to global equities and international investors concerned with understanding market dynamics and diversifying their investment portfolios.

I have kept mathematical discussion/notation to a minimum for the sake of accessibility. For those interested in the mathematical details, please feel free to email me at [email protected]

Tottenham Hotspur, renowned as the English Premier League's greenest club, is taking its commitment to clean energy to the next level by teaming up with VivoPower as its official battery technology partner.

VivoPower is one of the world's most trusted sustainable energy solutions (SES) providers. The company enables businesses to integrate cutting-edge battery technology into their day-to-day operations.

The exclusive two-year agreement will see the Spurs and VivoPower exploring solutions that will help the club reduce the environmental impact of its activities and, ultimately, become a net zero carbon business.

Donna-Maria Cullen, Executive Director of Tottenham Hotspur, said: "Science points towards an urgent need for businesses to decarbonise, and the club is always open to new technologies and innovations to help achieve this core aim."

The agreement with VivoPower is the first partnership of its kind within the world of football and shows the Spurs' goal to maintain its status as the greenest club in the league. "The work of companies like VivoPower with businesses like ours could be seen in years to come as an essential part of limiting the impact of climate change," she added.

VivoPower aims to incorporate a large, solid-state battery with a capacity of more than 3 MW at the Spurs' stadium to bolster the venue's clean energy supply. The battery company is also looking to install rooftop solar panels, battery storage, custom microgrid controls, and electrical infrastructure at the training centre.

Kevin Chin, Executive Chairman and CEO of VivoPower, commented: "We are delighted to be working with Tottenham Hotspur on what would be our first full suite SES deal, our first deal involving infrastructure assets and our first SES deal in the UK. Tottenham not only has a fantastic history and heritage as one of the world's pre-eminent football clubs, but also tops the Sport Positive Rankings as the English Premier League’s most sustainable club.

"As VivoPower is a certified B Corporation, we have to be sure that our partners share our goals and ethos. Given Tottenham's excellent sustainability credentials, we know we're partnering with a sports business that shares our values and vision.

"Our deal encompasses all aspects of our sustainable energy solutions which are available to all corporates looking to decarbonise far more rapidly than their competitors. We hope to assist Tottenham by delivering a turnkey SES outcome that enables the club to accelerate towards net zero carbon status.

"Both the stadium and training ground projects will serve as perfect ambassadors for VivoPower's work as we grow rapidly and help decarbonise businesses across the UK and all major international markets."