Shortly after the announcement of VivoPower’s successful signing of a definitive agreement to acquire Tembo e-LV B.V., we are proud to announce that VivoPower raised USD$28.75 million in an upsized public share offering.

On October 20, VivoPower closed an underwritten public offering to sell 2,941,176 ordinary shares to the public at the price of $8.50 a share.

On top of the original 2.9+ million shares, the underwriters have exercised an option to purchase 441,174 ordinary shares at the public offering price, less the underwriting discounts and commissions.

Due to strong demand from a range of institutional investors, the offering was upsized from its initial USD$15 million target. Gross proceeds―before underwriting discounts and commissions, and estimated offering expenses―will now be about USD$28.75 million. Net proceeds from the offering will supplement VivoPower’s existing cash and cash equivalents, which will be deployed to fund working capital needs and accelerate the expansion of operations into the commercial electric vehicle space. That expansion includes the recent acquisition of Tembo e-LV B.V., a specialist electric battery and off-road vehicle company.

We are proud to share that VivoPower signed a definitive agreement and is moving forward with the USD$4.7 million acquisition of Tembo e-LV B.V., a Netherlands-based specialist electric battery and off-road vehicle company.

This exciting acquisition confirms Tembo’s integral position in VivoPower’s sustainable energy solutions (SES) platform.

Tembo’s expertise suits VivoPower’s accelerated SES rollout

Tembo designs and develops a comprehensive fleet of customised electric vehicles (EVs), often for rugged applications. It services a diverse range of sectors from mining, infrastructure, and utilities to government services, game safaris, and humanitarian aid.

Given that VivoPower’s established customer base in mining, infrastructure, and utilities are some of Tembo’s core markets, it is eager about the prospects this acquisition presents. The company’s customers are already seeking unique opportunities to reduce their energy costs, increase productivity, and become more sustainable in the long-term. With Tembo, VivoPower can now offer them the compelling option to electrify their fleets.

The VivoPower and Tembo teams look forward to working even more closely to scale up their capacity to deliver customised and/or ruggedised commercial fleet electrification solutions. Tembo will enable VivoPower to accelerate the rollout of its sustainable energy solutions (SES) offerings, with an initial focus on the mining, infrastructure, and utilities sectors globally.

Our analysis of publicly available industry data indicates that the acquisition could triple our global addressable light vehicle (LV) fleet market to USD$36 billion in the markets where Tembo is currently active. That estimate does not include Asia, South America, or the US, which could represent even further potential.

Tembo will transform growth trajectory

Under the agreement, delivering EVs will become a pillar of VivoPower’s SES business.

Tembo Founder and CEO Frank Daams noted: "VivoPower’s investment will allow us to build capacity to meet pent-up demand from our customers and improve efficiencies of scale. Given that the Tembo and VivoPower teams have already started working together on customer requests for proposals, we believe that this will translate into a growing order book."

While Frank remains with Tembo to oversee its growth, VivoPower has the option to acquire the remaining 49% in the future. The transaction is subject to standard closing conditions, including capital structuring and funding mix requirements.

From wildfires in Australia to a global pandemic that has crippled entire economies, there’s probably little else about 2020 that would surprise us. Whilst these events have brought much devastation, they have also enabled many of us to reflect on how we can make change for the better and grow from these challenges. A recurring theme at Arowana’s recent quarterly Circle of Leadership (COL) was that it is often in times of crisis when opportunities to evoke real change can occur.

Like everyone else around the world, the team at Arowana have been reflecting on how we can play our part for society and the planet. Besides taking stock of the current situation and making plans, there is one important matter that is at the forefront of our minds: sustainable business operations.

For too long, businesses have operated in an unsustainable manner with little regard for social or environmental impacts. While the objective of any business is to earn a profit, doing so at the expense of people and the environment is unacceptable.

We have long believed that positive change should start from within. Therefore, we have chosen to commit to the UN Global Compact. The UN Global Compact consists of ten principles that address human rights, labour, the environment, and anti-corruption. Adhering to these ten principles is a crucial part of corporate sustainability―something all organisations should aspire to.

Here are the four reasons why we have chosen to support the UN Global Compact.

1. To take a stand against human rights violations and abuse of labour

In his letter to Thomas Mercer, the philosopher Edmund Burke states: “The only thing necessary for the triumph of evil is for good men to do nothing.”

Human rights violations are one of the biggest problems in the world today. All too often, unscrupulous companies ignore or even perpetuate the abuse of human rights for the sake of profit. However, we believe that the buck stops with us.

Under the UN Global Compact, internationally recognised human rights must be identified and always respected by every organisation and business entity. Along with this, businesses have a duty to ensure that they themselves are not complicit in human rights violations.

Taking this stand sends a clear message to our organisation as a whole and our respective stakeholders―Arowana will not tolerate any abuse or violation of human rights.

2. As a means of fostering a more diverse and inclusive workplace

Arowana has always been an equal opportunity employer that respects employees of all backgrounds. Confirming our support for the UN Global Compact further showcases our position as a diverse and inclusive workplace.

Additionally, harassment or abuse of any kind is not tolerated at Arowana, and employees receive regular training on appropriate workplace conduct. By implementing these practices, we hope to help eliminate discrimination based on race, gender, and other unprofessional behaviours in the workplace.

3. In order to protect and conserve the environment

“Sustainable business management” is not just another management term. It instead represents the key to the future. Years of exploitation and neglect have resulted in a polluted environment and a world that is overly reliant on finite resources. This is why it is more important than ever for businesses to practice sustainable development. Working in harmony with the environment by reducing our carbon footprint and promoting green technologies are ways to ensure that we leave the next generation a world far better than the one we inherited.

4. To stamp out corruption

Corruption in any form is and will always be damaging to a business. From the erosion of investor trust to business scandals, eliminating corruption should always be at the forefront of everyone’s minds. At Arowana, we uphold trust and integrity as key pillars of our business. With stringent audit checks and regular conflict-of-interest assessments in place, we take a zero-tolerance stand on corruption. Besides ensuring our compliance with the ten principles of the UN Global Compact, we will be able to inspire confidence in our stakeholders―something especially important to us―given the nature of our business. As the COVID-19 crisis has demonstrated, sustainable business practices where social and environmental factors are prioritised is the right way forward. Upholding sustainable business practice will not only enable us to contribute towards the bigger picture, but also ensure that we have a better world within which to operate.

On the 27th of August 2020, the Federal Open Market Committee (FOMC) released an update to its Statement on Longer-Run Goals and Monetary Policy Strategy. The update signalled a fundamental shift in the focus of US monetary policy to job creation and away from its traditional obsession with inflation.

The updated monetary policy framework relegates the former 2% inflation upper-bound to a supporting role with greater emphasis now placed on stimulating the economy as needed and signalling the tolerance for inflation in the short-run: “appropriate monetary policy will likely aim to achieve inflation moderately above 2% for some time.”

How will this new direction and focus of the US central bank play out over the next five years? What are some of the underlying motivations and drivers of this policy shift? To answer these questions, perhaps it is instructive to examine the evolution of recent economic history because it serves as an important contextual backdrop to contemporary policy formulation.

During the Great Depression of the 1930s and its immediate aftermath, there were two conflicting theories that aimed to explain its cause. On the one hand, economists of the “classical” school that subscribed to more liberal ideology pointed to government overreach and expansive government monetary policy for causing an asset bubble. On the other hand, John Maynard Keynes in his “General Theory” (1936), refuted these claims and postulated that it was the “animal spirits” of free-market capitalists that was to blame—which translates to the stern admonishment of following the “greed is good” philosophy of Gordon Gekko types (from the 2015 movie, Wall Street).

The classical school, comprising of thinkers such as Adam Smith, advocated minimal government intervention and attributed the stability of this system of liberalised economy to the convolution and eventual coalescing of aggregate human self-interest. In The Wealth of Nations (1776), Smith claimed that it was an “invisible hand” that “directed individuals and firms to work toward the public good as an unintended consequence of efforts to maximise their own gain.”

The Keynesian postulation was that aggregate demand was a function of capital investment and consumption by government and the people. The volatility of the stock market and the subsequent real economic impacts were a consequence of the evaporation of private investment due to the irrational, fear-driven decision-making of investors.

From this Keynesian perspective, fiscal intervention was essential to maintaining full employment. This insight served as a catalyst for a metamorphosis of the form of liberalism that dominated American politics.

Beginning with Franklin D. Roosevelt’s New Deal, the focus of this new brand of liberalism shifted from producers (the supply side) to consumers (the demand side). As Arthur Schlesinger, Jr. opined in Liberalism in America: A Note for Europeans (1962): “When the growing complexity of industrial conditions required increasing government intervention in order to assure more equal opportunities, the liberal tradition, faithful to the goal rather than to the dogma, altered its view of the state. […] There emerged the conception of a social welfare state, in which the national government had the express obligation to maintain high levels of employment in the economy, to supervise standards of life and labour, to regulate the methods of business competition, and to establish comprehensive patterns of social security.”

Milton Friedman and Anna Schwartz came to a separate conclusion about a possible cause of the Great Depression. In their book, A Modern History of the United States 1867–1960 (1963), they argued that it was the failure of the central bank—the Federal Reserve—that led to the stubbornly high unemployment that followed the stock market crash of the 1930s.

By sanctioning the failure of banks to stem the run-on cash, the Federal Reserve had orchestrated a catastrophic evaporation of liquidity through a reversal of the multiplier effect.

Friedman and Anna Schwartz concluded that it was the resulting material reduction in the supply of money and velocity of money that stifled aggregate demand and entrenched high levels of unemployment. We know from the Global Financial Crisis of 2008 that a similar pattern of financial institution failures—partly enacted by central governments in a reflexive protectionism of their own economies—contributed to the temporary collapse of the global financial system, giving rise to tsunamis of disastrous consequences for the real economy in the decade that followed.

Central Bankers of past decades such Paul Volcker and Ben Bernanke incorporated Friedman and Schwartz’s findings into modern-day central banking where central banks played a vital role in providing stability to the real economy through shocks to the financial or real economy. Public enemy number one according to these central bankers was inflation.

As Paul Volcker wrote in Keeping At It: The Quest for Sound Money and Good Government , his book co-authored by Christine Harper (2018): “A remarkable consensus has developed among modern central bankers … that there’s a new ’red line’ for policy: a 2 percent rate of increase in some carefully designed consumer price index is acceptable, even desirable, and at the same time provides a limit. I puzzle at the rationale. A 2 percent target, or limit, was not in my textbooks [a] year ago. I know of no theoretical justification.”

In his speech at the University of Chicago in 2002, Ben Bernanke said, “For practical central bankers, among which I now count myself, Friedman and Schwartz’s analysis leaves many lessons. What I take from their work is the idea that monetary forces, particularly if unleashed in a destabilizing direction, can be extremely powerful. The best thing that central bankers can do for the world is to avoid such crises by providing the economy with, in Milton Friedman’s words, a ‘stable monetary background’―for example, as reflected in low and stable inflation.”

But, as noted in the FOMC update of its Monetary Policy Strategy on the 27th of August 2020: the current preoccupation of the Federal Reserve is with driving down unemployment which leaves the door ajar to inflation.

With the monetary policy now hitched to the fiscal engine courtesy of the updated Monetary Policy Framework, the US has created a blueprint for central governments to set into motion debt-funded stimulus programs to revive a real-economy suffering from intrinsic or extrinsic shocks. The central banker’s role is to monetise this debt and keep interest-rates low using tools such as Quantitative Easing (QE).

But maintaining low interest-rates over a long period may give rise to unanticipated disinflation or deflation—through the Fisher effect (courtesy of Irving Fisher)—which could redistribute wealth to lenders and away from borrowers and disincentivise investment. This could lead to an upward spiral of government debt as debt-funded stimulus becomes necessary to support aggregate demand which has been the case in Japan over the past several decades.

So how does a central government go about repaying its debt? Three possible options it may consider are default, austerity, and inflation. The first two options are politically unsavoury whilst inflation can not only support government debt reduction but also redistribute wealth away from wealthy savers to those in debt—and more importantly, those willing to spend and consume.

But as discussed above, and has been the case in Japan, creating reserves in the central banking system does not translate to increased money supply. In other words, providing banks with liquidity does not necessarily translate to them adding to money supply by making loans.

Now what if the government could direct the banks to make loans and central banks could directly inject capital into debt markets by bypassing the banks? This would collectively have the desired effect of boosting money supply and—if the velocity of money and real GDP remained constant—it would drive up inflation. Welcome to the world of politicised credit and financial repression.

Beyond the control of banks (disintermediated capital flow), policymakers may wrest control from private and traded debt capital markets. The tools used in these interventions may range from the direct purchase of corporate credit as has been done in the US to the formation of sovereign loan funds—perhaps managed by the private sector—but with mandate restrictions that ensure that investment activity is aligned with the broader objective of employment creation.

In this new world order, in contrast to that described by free-market capitalism, government would direct and control the flow of capital. Employment, wealth equality, and wealth creation are objectives for the economy that are aligned with government’s incentive to win votes.

With the focus on job creation, capital flow, fiscal and monetary incentives, deregulation, and the dismantling of competitive moats would be showered on segments of the economy that provide the greatest opportunity for employment. These segments will differ from country to country. In Australia, for instance, the SME sector employs 44% of the country’s workforce (Australian Small Business and Family Enterprise Ombudsman (2019), Small Business Counts) and has been targeted through both Fiscal and Monetary policy intervention with banks being provided with government guarantees for loans to eligible companies and the Reserve Bank of Australia offering banks a subsidised funding facility to lend to small business in a manner similar to initiatives taken by the Bank of England.

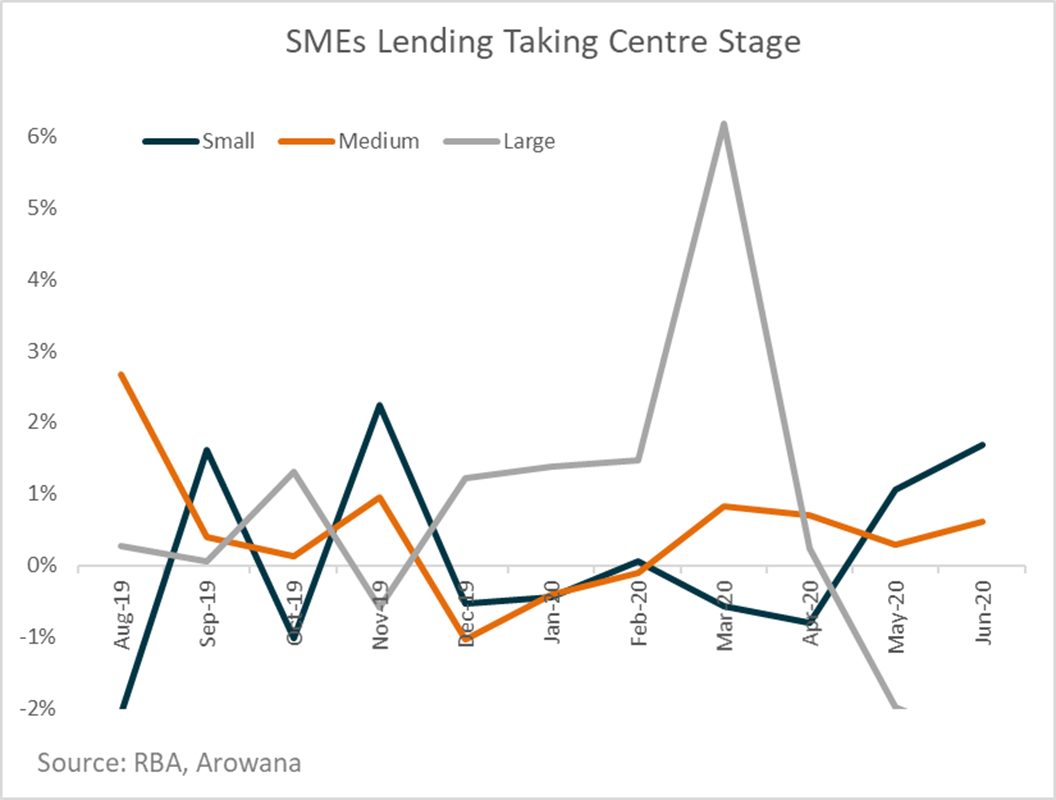

This chart of the rate of growth in lending to small, medium, and large business highlights the shift in debt capital flows to Small and Medium Enterprises (SMEs) in Australia.

The losers—from this deviation from liberalism—would be businesses that offer low incremental new jobs per unit of leverage—i.e., large business (refer to the chart above), banks, speculators, and savers.

With the prioritisation of consumption and employment, speculators that seek to leverage cash flows would be starved of capital. Savers would see the monetary value of their savings eroded by negative real rates of return with the banks being sanctioned to reduce deposit rates to conserve net interest margins and capital buffers.

Banks would be subject to government-directed lending in a low-interest-rate environment with the combined profit-corrosive forces of contracting net interest margins and rising credit provisions.

Large business would see competitive moats eroded and a narrowing of comparative funding access with SMEs.

Overall, saving is contractionary to an economy, and you will no longer be rewarded for it whilst credit will flow, and the cost of debt will be low.

I, for one, plan to go out and SPEND!

It's no coincidence that many of the world's greatest companies were born of economic crisis. Is yours next?

This article was originally published on Inc.com.

Kevin, our CEO, was asked about the process of becoming a B Corporation by Inc.com, and this is what he shared.

As an entrepreneur who has successfully navigated several difficult turnarounds and economic crises, what capital-raising hacks can a cash-crunched company use to raise survival capital during the COVID-19 crisis?

From your experience as an investor, what mistakes should a company avoid when seeking to raise capital?

Inauthenticity. It's a common mistake to portray your company in a "utopian bubble" with no risks, competitors, or operational challenges. Such inauthenticity is off-putting. Most investors, especially former entrepreneurs, know that it's not reality. Many pitch documents today omit risks. Interestingly, those that do address risks stand out and are more likely to attract capital, as they are viewed as authentic, conscious of risks and their mitigants.

Being unrealistic. Don't dress up a business as something it's not, in order to attract a high valuation. For example, trying to conjure a technology angle (often in the form of recurring "as a service" revenue streams that emulate richly-valued SaaS businesses), then characterizing the business with the customary tech "alphabet-raising label" (i.e., series A, B, or C round). While there is arguably more capital today than ever relative to the number of businesses, few investors are naïve enough to fall for this.

Failing to be selective. It may sound impractical in a crisis where it's tempting to take any dollar from anyone, but be careful about who you let on to your cap table or balance sheet. Investors who are not aligned will consume your time and energy to manage. In a worst-case scenario, the wrong investors can destroy a company. From my experience, the two biggest issues are a misalignment of investment time frame or risk appetite. It's critical to validate each potential investor's expectations for both factors in detail to ensure they are aligned with yours before accepting their money. If they're not, say no.

You recently consummated a successful capital raising with new investors for a business venture during COVID-19 lockdowns. How did you engineer this given the barriers to face-to-face meetings?

Credit mainly belongs to a couple of team members who refused to let Covid-19 be an excuse. We raised funds for a venture capital business where we, in turn, provide capital to "small and mid-cap" late-stage tech companies.

The key to raising capital from new relationships during Covid-19 lockdowns is to focus on your existing network and triangulating to "three degrees of separation" within it. Raising capital without face-to-face meetings is based on a "web of trust" dynamic where investors who don't know you will rely on someone in your network whom they know well, and who can advocate for you. It is also crucial to evidence that you are aligned to new investors by personally investing a meaningful amount of "hurt money" alongside them. Even though you may have invested significant sums beforehand, putting some money in the current round goes a long way to convincing new investors. It also helps if existing investors participate in the new capital raising, too.

You have a contrarian perspective that too much capital is not necessarily a good thing. Will you expand on that?

Having too much capital, whether as an operator or investor, can be dangerous territory that breeds suboptimal behaviour. I've been in this position, both as an operator and investor. At the risk of sounding masochistic, a crisis represents a cathartic opportunity to recalibrate and achieve a sustainable equilibrium of capital versus opportunities. It's no coincidence that many of the world's greatest companies were born out of economic crises, achieving outstanding growth despite capital constraints. Indeed, "capital fasting" can lead your company to a state of metabolic ketosis reinvigorated with entrepreneurial energy and creativity.

Record annual revenues of $48.7 million, despite COVID-19 lockdowns

Strong turnaround in adjusted EBITDA with an increase of $7.7m to $3.9 million

Strategic pivot to enter commercial electric vehicle (EV) market

Highlights for the fiscal year ended June 30, 2020:

A reconciliation of IFRS (International Financial Reporting Standards) to non-IFRS financial measures has been provided in the financial statement table included in the full earnings press release, which can be found here. An explanation of these measures is also included in the press release, under the heading, “About Non-IFRS Financial Measures”.

All amounts shown for the year ended June 30, 2019, are unaudited.

Following the completion of a twelve-month strategic review, VivoPower is expanding into the electric vehicle (EV) sector. The decision to expand into EVs was driven by interest from VivoPower’s existing customer base. The company expects to initially focus on providing light electric vehicles to customers in the Australian mining and infrastructure sectors before expanding globally. The light commercial vehicle fleet market (including pick-up trucks) is worth an estimated $12 billion in Australia alone, with most of the market represented by mining and infrastructure. VivoPower’s EV strategy will be differentiated in that it features a holistic, three-pronged sustainable energy solution (SES) to customers, which will include:

VivoPower’s Annual Results Presentation can be viewed here.

The Directors of AWN Holdings Limited (ASX: AWN) are pleased to release the Annual Report and the accompanying Investor Presentation for your review.

Statutory operating revenue for the year ended 30 June 2020 increased by 6% to $116.5 million (2019: $109.5 million) due primarily to significantly increased revenues from

VivoPower’s Aevitas business unit in Australia.

The statutory EBITDA and loss after tax from continuing operations for the year ended 30 June 2020 were a loss of $4.6 million (2019: loss of $3.7 million) and a loss of $13.1 million (2019: loss of $12.9 million) respectively.

Further information below:

AWN Annual Results for the Financial Year Ending 30 June 2020

AWN Investor Presentation for the Financial Year Ending 30 June 2020

We are pleased to have been able to offer some assistance again by supplying emergency food relief for those communities who have continued to struggle under the COVID-19 lockdown restrictions in the Philippines. In partnership with Grameen Pilipinas, our second collaborative effort provided 500 packs of food supplies to 500 households in Cavite, Quezon City, and Bulacan.

LONDON, June 17, 2020 – VivoPower International PLC (Nasdaq: VVPR) (“VivoPower” or the “Company”), an international solar and critical power services company, announced that it has assumed management control from its joint venture partner ISS in relation to its solar development portfolio in the US.

Given the focus on revitalising the US solar portfolio, the Company is also changing the composition of its board, with the appointment of three new non-executive directors, of which two are in the US and another in the UK. At the same time, the current non-executive directors have resigned, although may continue to be involved in different capacities with either VivoPower or its ultimate parent, AWN Holdings Limited.

VivoPower Executive Chairman and CEO, Kevin Chin, said: “We are very pleased to welcome Matthew Cahir (Washington, D.C.), William Langdon (New York) and Peter Jeavons (London) to the VivoPower board. Matthew has already been advising the Company for the last 18 months in relation to its US solar portfolio, William is a highly experienced executive with previous roles as CFO and COO, whilst Peter is a seasoned technology industry executive. Together, they bring a combination of strategic sales, technology, and software as well as finance and accounting experience, in both hyperturnaround and hypergrowth situations and accordingly are fit for purpose for the next stage of the Company’s evolution. Having turned around our Australian operations, we are now focussed on doing the same with our US portfolio. We would also like to take this opportunity to extend our gratitude to the outgoing non-executive directors, Shimi Shah, Peter Sermol, and Ashwin Roy who have helped to navigate VivoPower through some very challenging times over the past three years. We look forward to continuing to work with each of them in the future.”

Alicorn & Co. (Alicorn) has completed a US$6m co-investment in Glassbox Digital, a UK-based enterprise software company that recently closed a US$40m Series C round.

Alicorn is Arowana’s recently launched global venture capital arm and is headquartered in London. The new standalone entity is focussing on proprietary opportunities in enterprise software, cybersecurity, and data analytics. The current landscape has brought forward a period of digital transformation and with it, opportunities to invest in companies ready to take advantage.

Alicorn’s investment strategy is unique in that it focusses on exclusive primary funding rounds as well as providing secondary liquidity to shareholders of late growth stage technology companies. Alicorn works with these companies, their existing venture capital investors, and other stakeholders to participate in bespoke funding rounds and facilitate investments to solve liquidity requirements. The firm’s team span four continents with venture and advisory partners in the UK, Israel, the US, Singapore, and Australia.

About Alicorn

Established by Arowana, Alicorn is a global venture capital group that undertakes proprietary, exclusive primary and secondary investments in best-in-class, fast-growing technology companies in the enterprise software, cybersecurity, and data analytics sectors.

About Arowana

Arowana is a global B Corporation that has operating companies and investments across the UK, Southeast Asia, Australia, and the US. Established in 2007, Arowana’s purpose is to grow people, grow companies, and grow value.