As business owners, Arowana understands first-hand the challenges that companies face when trying to secure debt capital to expand. If your business has not reached $100m in revenue yet, you’re probably struggling to access funding for growth.

It’s a chicken and egg type of problem: to achieve their growth aspirations, businesses need to secure the working capital required for such growth. Traditionally, this capital requirement must be met through an equity injection from the sponsors and owners.

However, there are other funding mechanisms that bypass the banks, and are increasingly prevalent in providing much-needed finance to help SMEs achieve ambitious growth targets while addressing a $70bn funding gap.

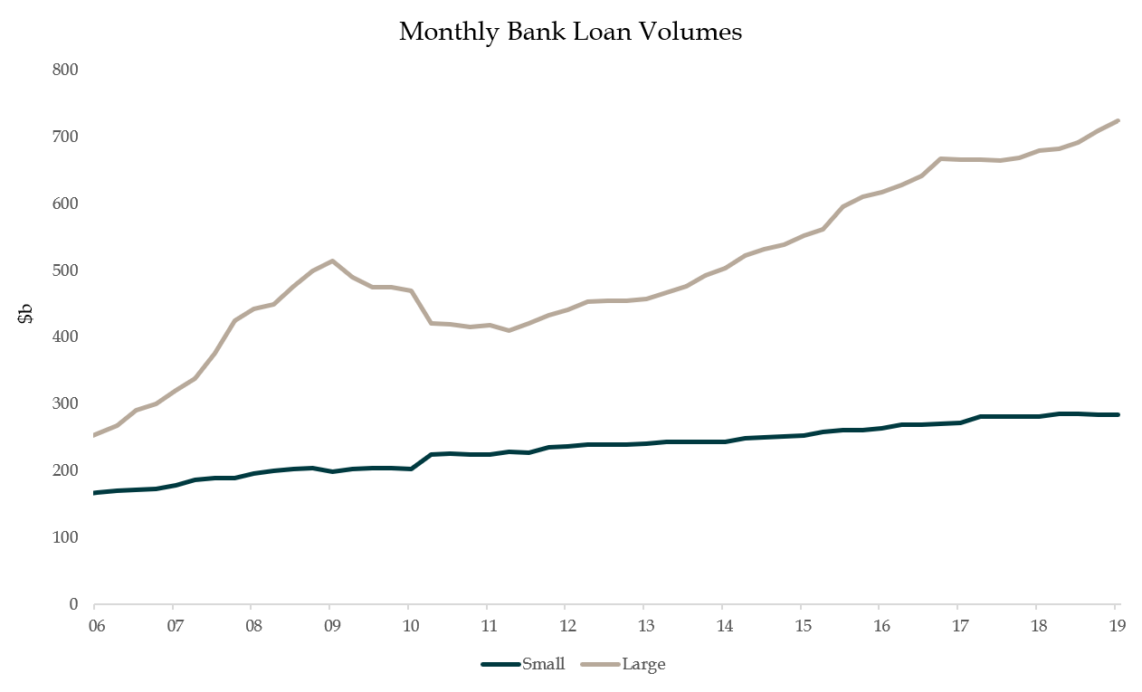

Many of our businesses are funded purely with equity. Traditional sources of debt funding, such as loans from the major banks, have been reserved for large businesses that turn over more than $100m. Businesses of a smaller scale must rely on mortgaging real property security to attract lenders. The chart below of bank lending to large and small business supports this thesis.

This is not just a problem that businesses face with the major banks. Regional banks and challenger banks are vying for a client base that fits the real property security mould. Cashflow-based loans for small business come in very small packages, and/or subject the borrower to very restrictive covenants.

Source: RBA, Arowana

Once a business surpasses a revenue threshold of $100m, there is no shortage of bank loan funding, and banks are also willing to take businesses to the domestic high-yield debt market. The high-yield debt market is funded by institutional investors, such as Superannuation Funds and Investment Managers, that buy corporate loans on behalf of their clients. Banks will usually arrange, underwrite, and distribute the high-yield debt instruments of their large borrowers.

Investors in syndicated debt and large corporate credit are not supplying liquidity to the small business community; they are merely reducing the cost of funding for large businesses and adding to the fees and costs that investors and borrowers must bear, with less than incremental contributions to both these communities.

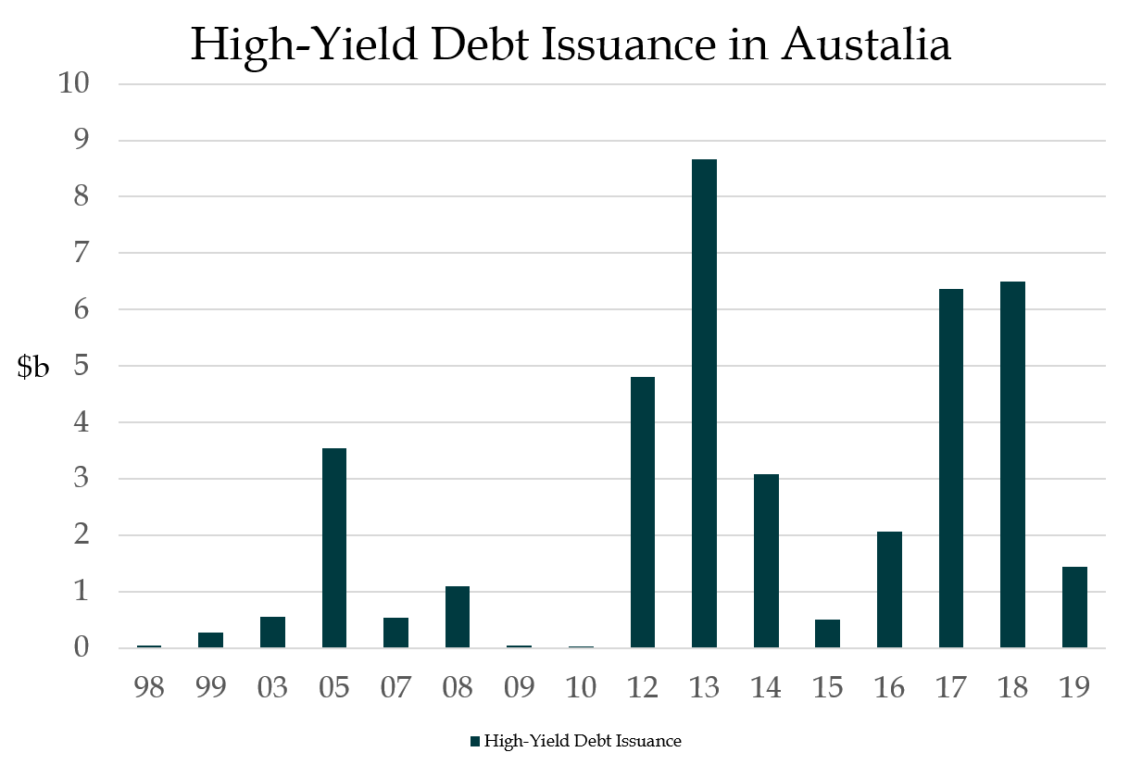

High-yield debt issuance, mostly in the Syndicated Loan format, supplied $3.4b p.a. over the past five years. Most of this debt was provided to large corporate borrowers.

Source: Bloomberg, Arowana

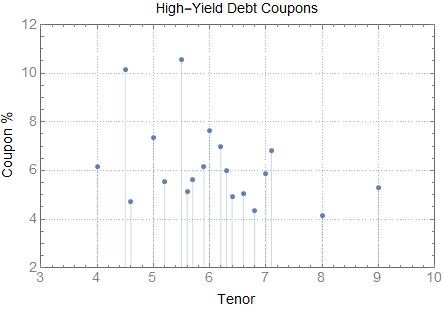

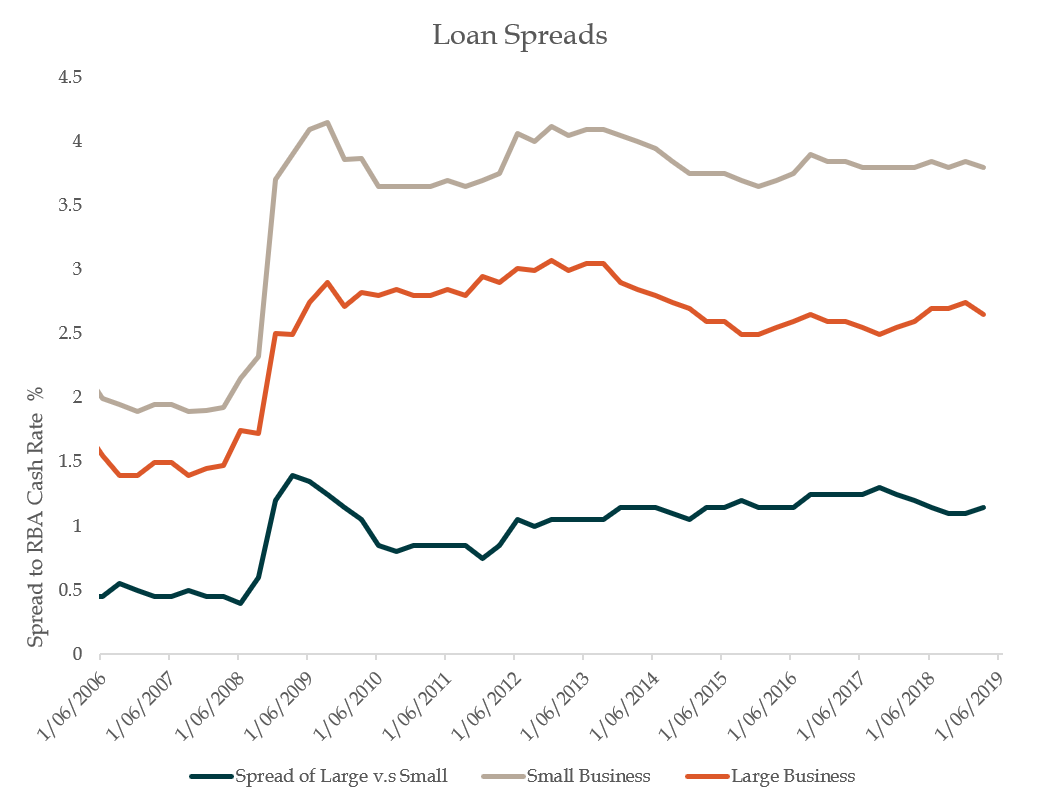

Debt in the high-yield market has attracted an average rate 7% p.a. for tenors between four to six years, while bank debt, traditionally amortising over four to six years, has an average rate of 4.5% p.a. over the past five years. Small businesses―those that borrow less than $2m―have a comparable bank funding cost of 1% p.a. more than large business.

Source: Bloomberg, Arowana

Source: RBA, Arowana

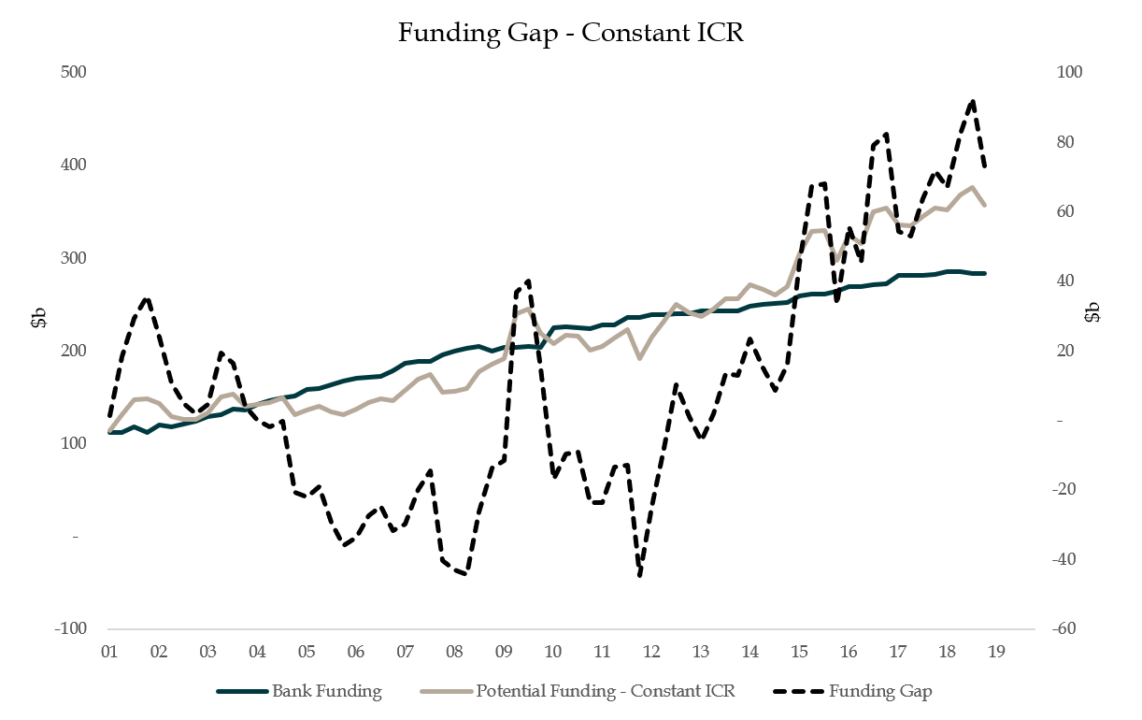

The debt capacity of these businesses (using constant Interest Cover Ratio - ICR) suggests that the funding shortfall plaguing small business currently exceeds $70b. In estimating this funding shortfall, Arowana applied a constant debt capacity to contemporary borrowing costs and profitability[1]. This estimate is corroborated by research independently conducted by Macquarie Bank[2].

Source: RBA, Arowana

In November 2018, the Morrison Government announced a plan to bridge this funding gap with a $2b Australian Business Securitisation Fund[3] that will invest up to $2 billion in warehousing and the securitisation market to improve the access that small businesses have to debt funding. The new fund will be administered by the AOFM. In February 2019, the government introduced legislation to implement the fund. The fund will target investment in securities issued by warehouses alongside other private sector investors. These warehouses provide funding to smaller banks and non-bank lenders for loans extended to small business.

On the private funder side of the fence, asset-based fintech firms are taking the lead on meeting this pervasive funding gap.

Closing the gap: Asset-based Lenders

Asset-based lenders extend loans to small businesses secured by tangible assets such as debtor ledgers, vehicles, equipment, and inventory. In 2018, invoice financiers alone have funded close to $87b of assets[4] for small and large business in Australia.

Working capital funding of this nature is ideal for businesses with high-growth aspirations as it removes the obstacle of dynamic asset funding that is a prerequisite for that growth.

Debt facilities offered by these entities will typically involve revolving credit lines and cash flow loans that release liquidity from and equipment, property, or self-extinguishing assets such as debtors.

Debt facilities related to self-extinguishing assets such as debtors, fluctuate with the asset balances that they fund and so reduce the funding risk for borrowers. This harmonisation of the timing of assets and liabilities reduces liquidity risk for borrowers and lenders with additional comfort.

On a micro level, this type of funding provides a critical avenue by which individual SMEs can access finance. Meanwhile, on a macro level, it is beginning to address a massive funding gap that is slowing down some of the country’s most promising SMEs, which are the lifeblood of the Australian economy.

[1]

[2] Macquarie Bank Research, “The Computer Says Yes”, March 2015.

[4] FCI, Annual Review 2019, AUD/EUR 60 cents as at 26/08/2019