Energy underlies the entire fabric of society and the global economy. It's the basis of everything we do and everything we produce. However, we also know now the major side effects of this carbon-hungry economic growth that we've had.

The most pressing issue the world faces this decade is the transition from fossil fuels to sustainable renewable energy. To drive exponential growth in sustainable energy use, first there must be political will globally. The good news is that, especially considering the COVID-19 pandemic, governments around the world have committed to a sustained focus on creating net zero carbon economies.

However, political commitments will only take us so far and are not enough and not sustainable in their own rights.

Our mission at VivoPower is to provide accessible solutions to corporates to accelerate their own decarbonisation. We are part of a new generation of B Corps acting as a catalyst for change, marrying the needs to decarbonise our future with solutions that fit current economic realities. We take a total solutions approach to the problems that companies are looking to address.

VivoPower has been designed from the ground up as a practical, effective, end-to-end decarbonisation solution for corporates. Over the years, we have assembled the components that a sustainable energy solution requires. From a base of solar power projects and equipment, we are now a single turnkey supplier of all sustainable energy hardware and infrastructure, and this includes our Tembo electric vehicles.

Our integration takes sustainable energy solutions out of the early adoptive phase. Without VivoPower's integrated solutions, the complexity of putting together sustainable energy components into an effective and economic solution would still somewhat hinder corporates from addressing energy challenges.

Today, DDLS announced DDLS People, a diversification from Australia’s largest provider of corporate IT, into strategic advisory and project management services.

The new business unit builds off DDLS’s 20-year history of delivering complex logistics and supply chain projects, as well as learning and development activities to the Australian government, primarily the Department of Defence.

DDLS People will continue to provide these services to the Department of Defence, while increasing and improving its offering to include strategic advisory and project management services. The new investment is aimed at expanding the company’s reach into the greater public sector, as well as private enterprises.

Jon Lang, CEO of DDLS commented: “This is an exciting step for DDLS, as we continue to expand our reach into strategic advisory services. The launch of DDLS People is our commitment to innovate the way we service our clients with skilled consultancy. DDLS People has a long and established history working with the Department of Defence and a range of government organisations and corporations to deliver successful programs and outcomes.”

DDLS People currently services some of the largest agencies within the Department of Defence and has a solid track record of delivering results with commitment and passion for the past two decades. Since its inception, DDLS People has delivered over 200 Defence projects and upwards of 1,000 logistics systems training courses per year to organisations such as the Navy, Army, and Air Force.

The DDLS Portfolio of business units now consists of DDLS Training, The Australian Institute of ICT, and DDLS People, with eight offices across Australia and Asia.

As investors and operators of enterprises, the Arowana team is all too familiar with how mission-critical technology is to businesses and consumers alike. A few high-growth companies are standout technologies in their space, and we are looking forward to supporting them on their next stage of growth.

Alicorn Global Ventures, our global venture capital firm, completed a busy first quarter of CY2021 with two secondary investments in fast-growing technology companies totalling US$13.5m. Both investments are proprietary opportunities that remain confidential at the time of writing.

Alicorn recently invested $3.5 million in a global DevOps software company with a continuous delivery and collaboration platform for cloud-native applications and microservices. Its modern CI/CD platform is designed for software development teams building and deploying cloud-native applications using containers, serverless, and Kubernetes.

Alexander Assim, Principal at Alicorn said: “DevOps is at the centre of two critical trends in enterprises over the last decade: a mass transition to cloud-native systems, and a new mission criticality to the performance of business software and IT infrastructure. Today, the average enterprise has approximately 500 custom applications and will develop and deploy approximately 40 new applications in a year. That challenge is being solved through CI/CD and DevOps automation.”

In addition, Alicorn has also completed a $10m co-investment in a mobile commerce monetisation company. The company’s AI/ML-powered technology enables frictionless commerce for users by presenting superior discovery recommendations, at the edge, thereby protecting user data from leaving the device. The platform infers what products and services the user might be interested in and generates recommendations in a seamless manner that complements existing user interaction. The company’s technology is distributed to millions of Android users worldwide through telecoms carriers, member organisations, and other entities. It recently received iOS-certification, further increasing its already significant addressable market.

“The company has achieved substantial growth through technology that improves the commerce experience of mobile device users without ever opening an application. We’re excited to be investing at such an inflection point for the team, before the release of their next product generation, and with it an exit from stealth,” notes Alexander Assim.

We are pleased to have led both investments in companies that already count the likes of Microsoft, Red Dot Capital Partners, and JRJ amongst their investors. We look forward to the journey ahead with our co-investors at Arowana and further investments from the wealth of opportunities we continue to see in the market.

The Australian Institute of ICT (AIICT), a division of DDLS, has introduced a new series of industry-certified bootcamp programs and nationally-recognised qualifications to meet the surging demand for skilled ICT professionals in Australia.

AIICT is a startup launched in 2019 by DDLS, Australia’s largest provider of corporate ICT and cybersecurity training. Since launch, AIICT has enrolled over 500 students, with enrolment numbers continuing to grow month on month. Through its unique Industry Partner Program, AIICT connects recent graduates with leading employers to help them secure a frontline role while simultaneously tackling skills shortages in the field.

The bootcamps support the Morrison government’s recently announced Digital Skills Organisation (DSO) pilot, which recognises the importance of non-accredited training to support the skills development of the future workforce. The bootcamp programs run for six months and comprise of several vendor-specific certifications. The courses include “Cloud Computing Certified Professional”; “Certified Microsoft Full Stack Developer”; “Certified Artificial Intelligence Professional”; “Growth Marketing Professional”; and “Certified Project Management Professional”.

The decision to introduce the bootcamps follows the VET sector’s increasing move away from nationally recognised qualifications to vendor-specific, industry-certified training. According to the National Centre for Vocational Education Research, preference for accredited training courses has declined steadily in recent years, with employers increasingly less satisfied that these courses provide their employees with the most relevant and important skills for their business. This has led many organisations to prefer non-accredited training provided by private technology vendors such as Microsoft and AWS.

Jon Lang, CEO of DDLS said: “Our customers are definitely showing a growing interest in non-accredited vendor certifications. One key reason for this is that employers want to develop skills that are highly relevant and specific to the programs and services their organisation uses daily. Non-accredited vendor certifications can be customised to the specific needs of the business, compared with traditional accredited courses which contain more broad course content.”

“While our industry certified bootcamp programs continue to gain popularity, there will always be a place for nationally-recognised qualifications, which cover all of the fundamentals and provide students with a solid foundation to launch their careers in technology. We understand that every individual and business have different training preferences, and it is imperative that we provide more training options in both the non-accredited and accredited realms if we are to tackle Australia’s critical ICT skills shortages.”

AWN Holdings Limited reports statutory operating revenue for the half-year ended 31 December 2020 of $57.9 million (2019: $68.6 million) due primarily to operational disruptions and delays in the commencement of projects within VivoPower’s Aevitas business unit due to COVID-19, offset by strong growth in revenue generated by EdventureCo’s DDLS business unit.

The statutory EBIT and loss after tax from continuing operations for the half-year ended 31 December 2020 were a loss of $3.6 million (2019: loss of $2.8 million) and a loss of $4.0 million (2019: loss of $5.0 million) respectively.

Group net cash position increased to $35.3m as at 31 December 2020 (30 June 2020: $12.6m), reflecting VivoPower's successful capital raising.

For further information, please follow the links below:

AWN Interim Financial Report for the Half Year Ending 31 December 2020

AWN Investor Presentation for the Half Year Ending 31 December 2020

AWN Interim Results Update with CEO, Kevin Chin and CFO, Cameron Fellows (Audio)

Revenue, GP, and EBITDA decline due to strict COVID-19 lockdowns in Australia

Strategic pivot to enter commercial electric vehicle (EV) market completed with Tembo e-LV acquisition

Completion of 100% purchase of Tembo post-balance date ahead of plan

Execution of transformational $250 million partnership deal with GB Auto in Australia

First sustainable energy solution (SES) deal with Tottenham Hotspur Football Club

Highlights for the half-year ended December 31, 2020 (and key post-balance date events):

VivoPower's interim results presentation can be viewed here.

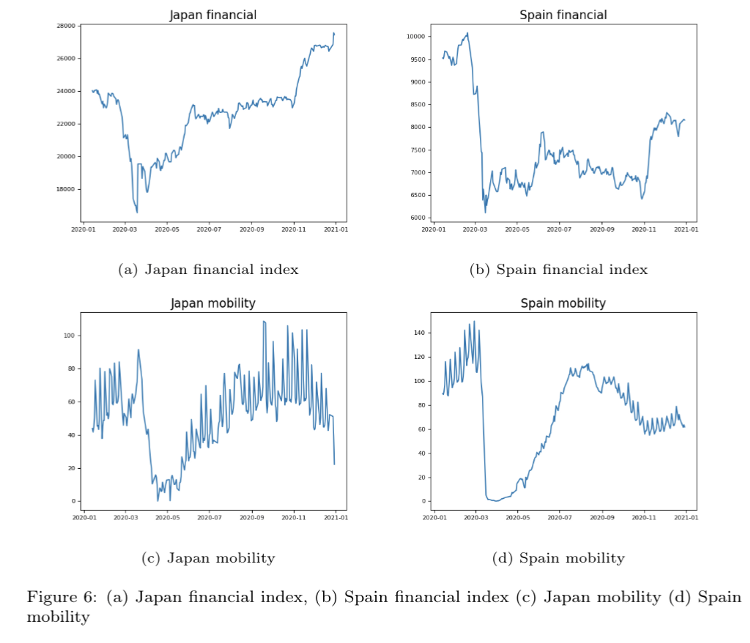

In this paper, we undertake a mathematical investigation of 20 countries to answer three questions in relation to the evolution of the COVID-19 pandemic, the real economy and the financial economy. We study three multivariate time series measuring country’s daily mobility data, daily COVID-19 cases, and financial index performance. First, we analyse wIn this paper, we undertake a mathematical investigation of 20 countries to answer three questions in relation to the evolution of the COVID-19 pandemic, the real economy, and the financial economy. We study three multivariate time series measuring a country’s daily mobility data, daily COVID-19 cases, and financial index performance. First, we analyse which countries behave similarly with respect to each of these features independently. Second, all countries’ trajectories are studied in conjunction to determine if any two candidate features exhibit more pronounced similarity. We demonstrate that mobility data and financial indices exhibit the most similarity in their trajectories. Finally, we study whether there is a difference in the time taken for COVID-19 cases data to be reflected in financial index performance and economic activity. A new optimisation method is introduced which demonstrates that mobility data tends to lag financial market performance, highlighting greater efficiency among financial market participants than governments in considering and acting upon new COVID-19 data. This finding suggests that studying mobility data as a leading indicator for financial market performance during the pandemic was, at least in the short-term, misguided.

During the pandemic there was a surge of interest in alternative data among the investment management community. One of these data sources was Apple mobility data. The basic hypothesis here, was that mobility data may be a leading economic indicator and provide insights into the probable movement of financial indices. The initial motivation for this stuDuring the pandemic, there was a surge of interest in alternative data among the investment management community. One of these data sources was Apple mobility data. The basic hypothesis here, was that mobility data may be a leading economic indicator and provide insights into the probable movement of financial indices. The initial motivation for this study sought to determine whether such mobility data provided any use to investment managers in their estimating future performance of respective financial indices. The countries included in this study are Argentina, Australia, Brazil, Canada, Denmark, France, Germany, India, Italy, Japan, Mexico, the Netherlands, New Zealand, Norway, Russia, Singapore, Spain, Switzerland, the UK, and the US. For each country, we analyse three time series (COVID-19 new cases, financial index performance, mobility data). Our analysis uses data starting 1/1/2020 and ending 30/12/2020. The data sources are Bloomberg, Apple Mobility, and Our World in Data.

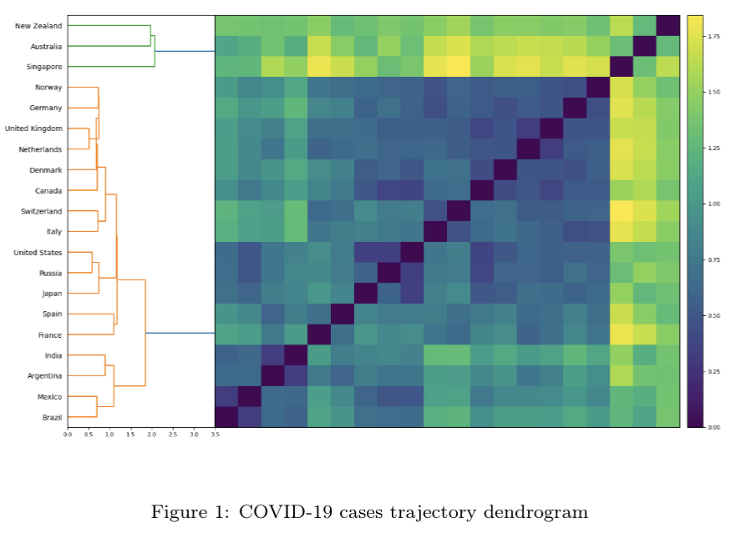

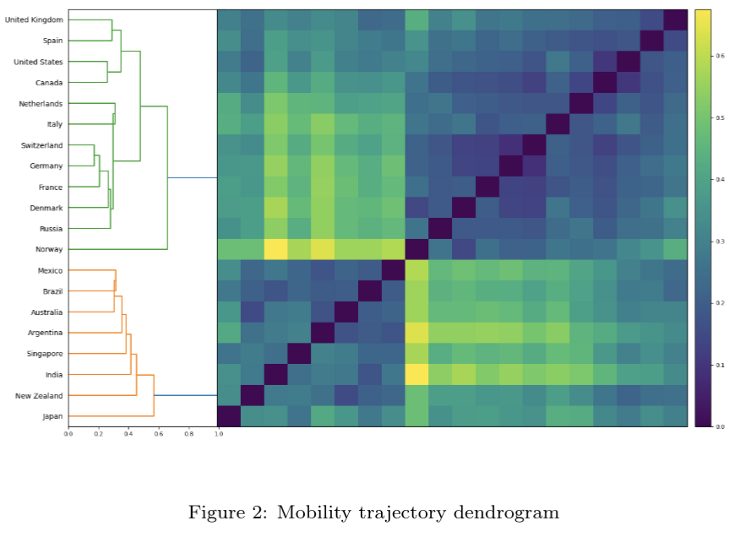

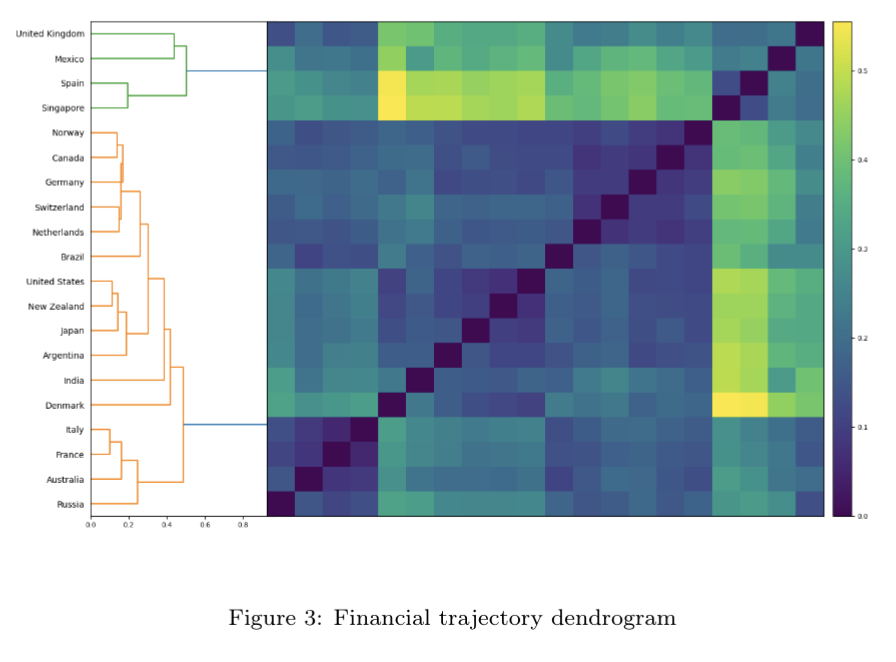

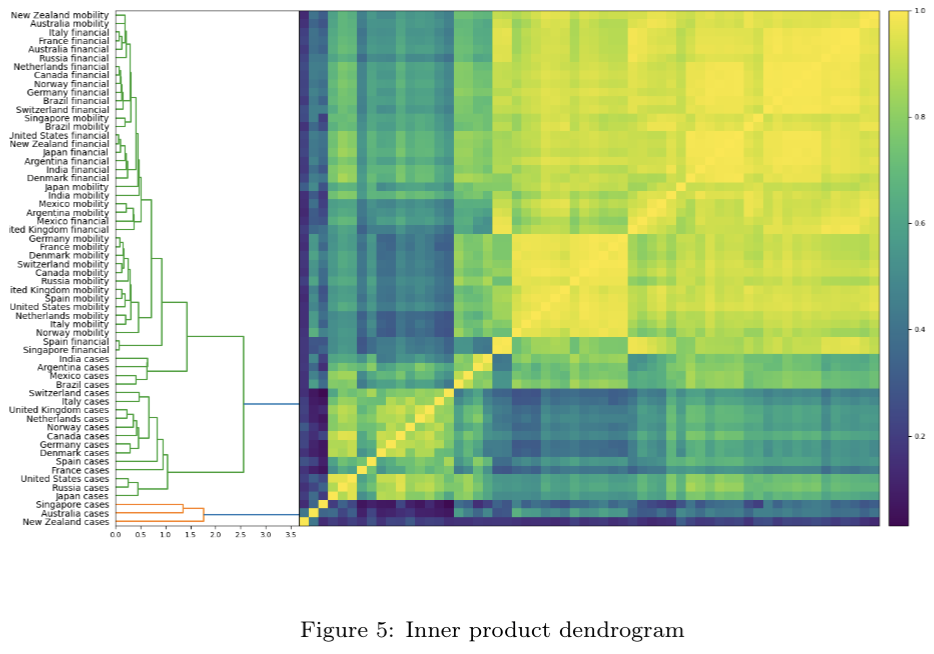

In this section we study the independent behaviours of COVID-19 new cases, mobility activity and financial index pIn this section, we study the independent behaviours of COVID-19 new cases, mobility activity, and financial index performance among our 20 countries of interest. In each section, we generate a distance matrix between the normalised trajectories of each country’s respective feature. We apply hierarchical clustering to each distance matrix to study the groupings and candidate similarity among countries. A summary of clustering results is below.

COVID-19 cases

The COVID-19 cases trajectory dendrogram is comprised of 2 clusters, a large predominant cluster and a small cluster oThe COVID-19 cases trajectory dendrogram is comprised of two clusters, a large predominant cluster and a small cluster of anomalous outliers, namely New Zealand, Australia, and Singapore. The larger cluster is characterised by new case trajectories exhibiting multiple waves of new cases, with many countries experiencing growth in cases toward the end of 2020. The common theme among the countries in the anomalous cluster is their low total number of cases throughout 2020, and their suppressed growth in cases toward the end of 2020.

Mobility activity

The mobility activity trajectory dendrogram is comprised of two more equally-sized clusters. The first cluster includes Mexico, Brazil, Australia, Argentina, Singapore, India, New Zealand, and Japan. Mobility trajectories within this cluster are consistently increasing (or, in select instances, flat) among these countries. These trajectories are representative of countries that experienced waves of COVID-19 cases earlier in 2020, imposed restrictions to reduce case numbers, and gradually reopened their economies. The second cluster consists of the UK, Spain, the US, Canada, the Netherlands, Italy, Switzerland, Germany, France, Denmark, Russia, and Norway. All mobility trajectories for countries within this cluster possess declining trajectories in their mobility. This is almost certainly due to government restrictions in respective countries, which were in response to significant growth in COVID-19 cases and deaths. Interestingly, the two clusters exhibit geographical affinity. The first cluster consists of countries in South America and Oceania, while the second cluster comprises European and North American countries. This highlights the similarity in the timing of lockdowns among many countries in proximal geographies.waves of COVID-19 cases earlier in 2020, imposed restrictions to reduce case numbers, and gradually reopened their economies. The second cluster consists of the United Kingdom, Spain, the United States, Canada, the Netherlands, Italy, Switzerland, Germany, France, Denmark, Russia and Norway. All mobility trajectories for countries within this cluster possess declining trajectories in their mobility. This is almost certainly due to government restrictions in respective countries, which were in response to significant growth in COVID-19 cases and deaths. Interestingly, the two clusters exhibit geographical affinity. The first cluster consists of countries in South America and Oceania, while the second cluster comprises European and North American countries. This highlights the similarity in the timing of lockdowns among many countries in proximal geographies.

Financial index performance:

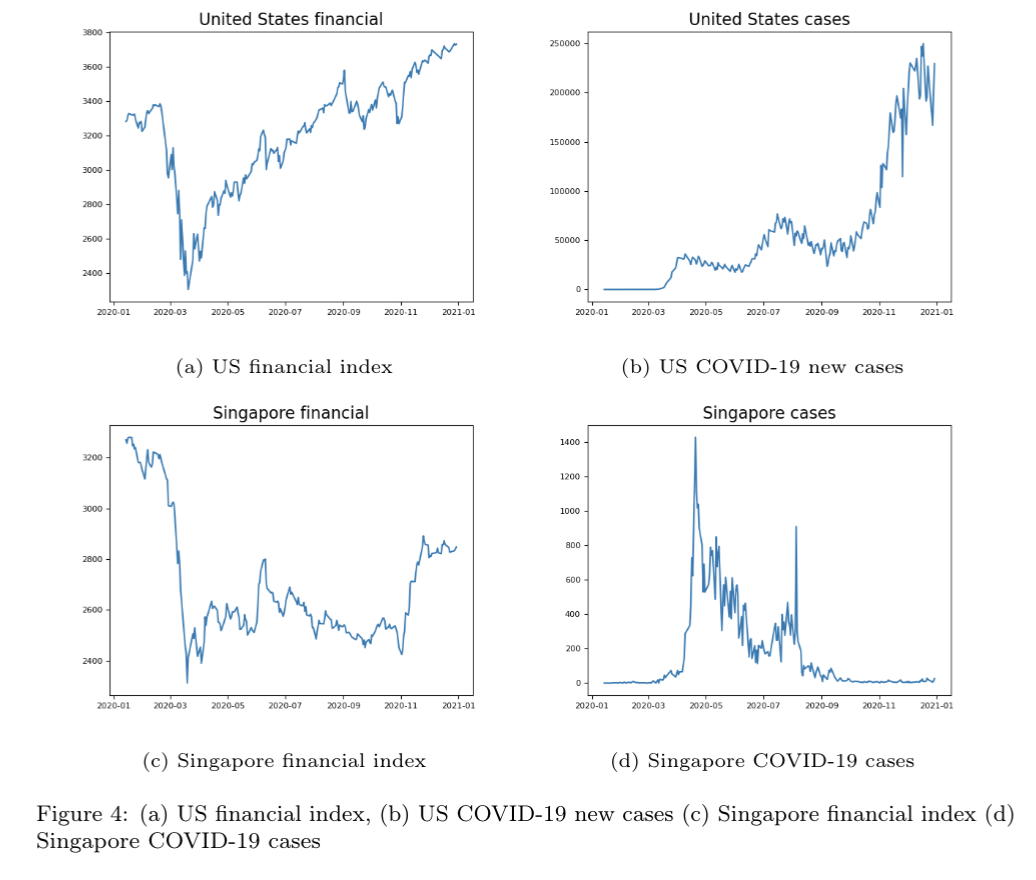

The financial trajectories dendrogram consists of two clusters, a primary cluster and a smaller anomalous cluster. The anomalous cluster consists of the UK, Mexico, and Singapore. The outlier cluster is comprised of countries that share similar financial index trajectories. Specifically, there is a large drop in March, a subsequent drop in November, and a slight to moderate recovery during the latter half of November and December. Interestingly, all these countries’ financial indices finish 2020 at a level lower than their pre-COVID position. The dominant cluster which consists of the remaining countries, exhibits far fewer uniform trajectories. However, many countries in the dominant cluster experienced more substantial recoveries than the anomalous cluster. For instance, the US and New Zealand (which possess highly similar trajectories) both post consistent gains after their precipitous drops in March.

Trajectory associations and interplay

The preceding analysis highlights several noteworthy points regarding the consistency in country cluster behaviours in reference to the above features.

Next, we seek to determine collective similarity among country attributes that we have studied. To do so, we generate a 60 x 60 matrix measuring the normalised inner product between all attributes’ trajectories and apply hierarchical clustering to the resulting distance matrix. The results can be seen in Figure 5. There is obvious structure in this dendrogram. Financial and mobility activity trajectories are highly similar, while COVID-19 case trajectories are significantly less similar. This makes sense. Both the mobility and financial index trajectories exhibit similar shapes; there is generally a sharp drop around March, followed by a subsequent recovery in activity and gains respectively. COVID-19 cases on the other hand exhibit dissimilar trajectories. First, COVID-19 case trajectories between countries are much more dissimilar—influenced by many factors such as the government’s willingness to enforce restrictions, the restriction of travel and human movement, etc. Second, COVID-19 case trajectories are prone to “wave” behaviour, where there may be multiple peaks and troughs throughout the evolution of a country’s 2020 case numbers. Interestingly, there is no tendency for trajectories to be grouped based on country. For example, the Japan COVID-19 cases, financial index performance, and mobility trajectories do not cluster similarly. Given the collective phenomenology, one would naturally wish to understand whether COVID-19 cases impact financial indices or mobility activity first—and whether this varies among countries.

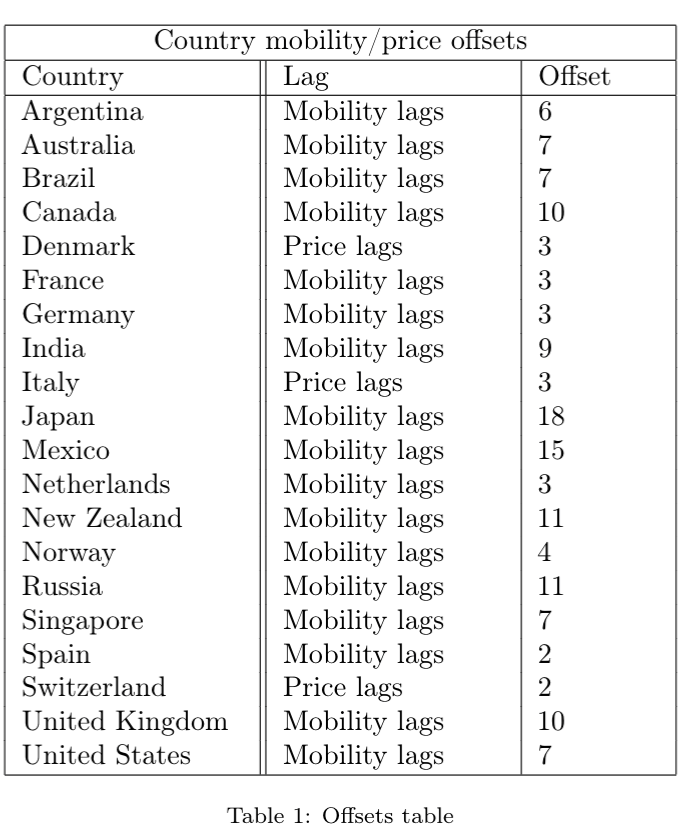

Given the similarity in the behaviour of mobility activity and financial index performance, we now compare the efficiency of governments and financial market participants in their use of COVID-19 data for decision-making. To do so, we introduce a new inner product-based optimisation framework, where the objective function is to estimate an offset between any two trajectories such that their inner product is maximised. Effectively, this aligns the major peaks and troughs in any two candidate trajectories. In this model, we assume that either mobility activity or financial index performance may be the laggard. The offset results displayed in Table 1 reveal several findings.

All studies have their limitations, and this one is no different. Our analysis could be improved in several ways. First, one could study more granular financial and mobility data. It is possible that in analysing data that is aggregated at the country and financial index level respectively, we may be ignoring subtleties in the data and may fail to capture important relationships.

There are several interesting findings in this work. First, we demonstrate that there is very little consistency in cluster behaviours or constituents when studying the trajectories of COVID-19 cases, mobility activity, and financial index performance. This was most clearly evidenced by Singapore, who managed their COVID-19 case numbers particularly well and had particularly weak performance in its financial index. By contrast, while the US experienced huge COVID-19 case and death numbers, the country index produced strong performance after the market crash in March. Next, we demonstrate that financial index and mobility trajectories are most similar, with no tendency for trajectories to be grouped around their respective countries. Having established this similarity, our new optimisation method demonstrates that mobility trajectories generally lag financial index trajectories. This suggests that throughout the pandemic, financial market participants incorporated COVID-19 case numbers into their trading decisions faster than governments were able to act on this information by way of instituting restrictions.

I have tried to keep mathematical notation to a minimum for the sake of readability. If you have any questions related to the above article, please feel free to contact me at [email protected]

The Board of AWN Holdings Limited (AWN or the Company) is pleased to appoint and welcome Ms. Claire Bibby as a Non-Executive Director of the Company commencing on 22 February 2021.

Sydney-based Claire is a highly experienced lawyer and professional coach with over 25 years’ experience in Executive and Non-Executive Director roles with ASX, multinational, private, and NFP organisations.

Her career has included senior management appointments with some of the world’s largest companies and top-tier law firms, where she has provided her clients with a range of strategic, governance, innovative, individual, and team leadership services.

Further information on Claire's appointment can be viewed here.

For over a decade, Real Leaders―the world’s first business and sustainable leadership magazine―has been recognising leaders and organisations that make a positive social or environmental impact with the Real Leaders Impact Awards.

We are very proud to announce that for the second straight year, Real Leaders has recognised Arowana's commitment to the triple bottom line of people, profit, and planet. This year we’ve earned a No. 27 ranking among the top 150 Impact Companies worldwide.

As a certified B Corp since 2018, we earned this spot thanks to our “Force for Good” score on the B Impact Assessment. We have a long-term commitment to building strong, sustainable businesses that will positively impact economies, industries, and the people they employ. Today our operating companies and investments include electric vehicles, renewable energy, vocational education, technology and software, road infrastructure services, and impact asset management.

Mark Van Ness, Founder of Real Leaders said: “These top impact companies prove that businesses can thrive by being a force for good. They are the Real Leaders of the New Economy.”

The 2021 award-winners include game-changers such as Tesla, Beyond Meat, Patagonia, and 147 other well-respected impact brands of all sizes and from a variety of industries.

Kevin Chin, Founder & Chairman of Arowana said: “We are honoured to accept Arowana's second Real Leaders Impact Award. At Arowana, we always consider the impact of our actions and strive to act responsibly, and we aspire to see businesses and economies grow in a sustainable way. This aligns with the Real Leaders mission to find profitable solutions that also benefit humankind."

A special ceremony will be held on January 27th, 2021 to honour the winners and will include key impact speakers featuring Seth Goldman, Chairman of Beyond Meat and a musical performance from Michael Franti, world-renowned musician and activist.

VivoPower is excited to ring in the New Year with a new look!

Check out our new website, now featuring more information on how our sustainable energy solutions―including Tembo eLV, B.V. electric vehicles, solar systems, batteries, and critical power services―can work for you and your business.

Visit here.